What Does A Negative PE Ratio Mean Exactly?

Can a company losing money still be a good investment? The answer lies in understanding negative PE ratios. While often a warning sign, they can be typical for high-growth companies prioritizing market share over immediate profits. Learn how to evaluate companies with negative PE ratios and uncover hidden investment opportunities.

There are a few times in life when using the word negative is actually great news—like when you’re waiting for the results of a medical test. A negative test for the flu? Awesome. Negative for allergies? Even better! But when it comes to money, investments, and the stock market, negative isn’t exactly something you want to celebrate. Enter the negative PE ratio, the finance world’s version of bad news. A negative PE ratio means a company is losing money, and unlike that negative flu test, this is not something you’ll want to brag about.

What is a negative PE Ratio?

The price-to-earnings (PE) ratio is one of the most common financial metrics used to evaluate a company’s stock price relative to its earnings. A negative PE ratio occurs when a company’s earnings (net income) are negative, meaning the company is experiencing a loss rather than making a profit.

The formula for calculating PE ratio is:

PE Ratio = Price per Share / Earnings per Share (EPS)

When the EPS is negative, the resulting PE ratio becomes negative. This can be an indicator that a company is not performing well financially or is in a growth phase where high investments are driving down profitability.

Is a negative PE ratio bad?

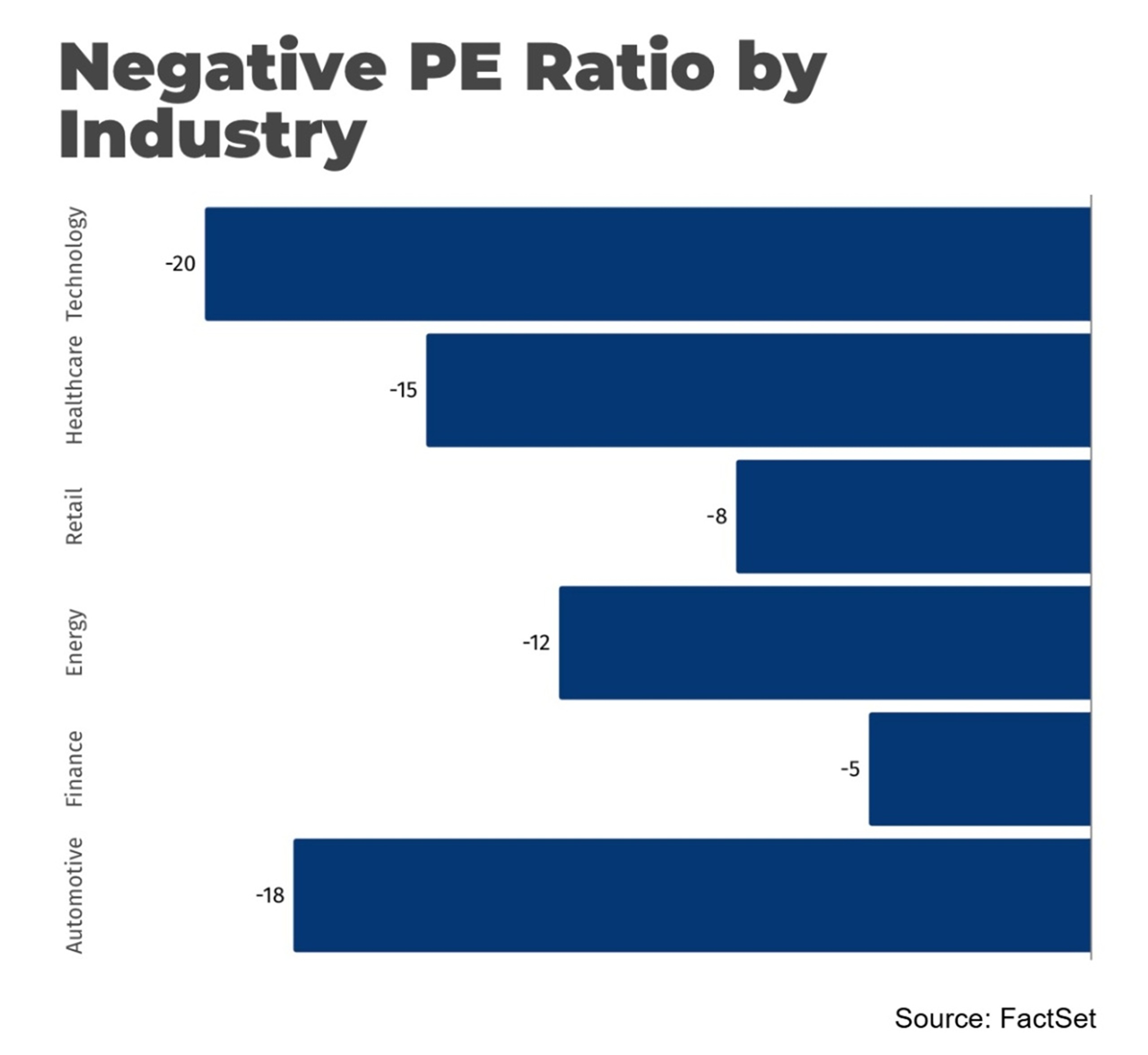

In most cases it is. When the EPS is negative, the resulting PE ratio becomes negative which can be an indicator that a company is not performing well financially or is in a growth phase where high investments are driving down profitability. It’s important to note here that companies and their books come in all different shapes and sizes and some industries and companies will indeed have negative PE ratios for a period of time.

A negative PE ratio is generally considered a red flag, but just like anything in life the context matters. For some companies, especially startups or those in tech, a negative PE ratio can be common as they reinvest their revenue into growth rather than reporting profits. However, in mature companies, a negative PE ratio usually signals trouble, like poor financial health or mismanagement.

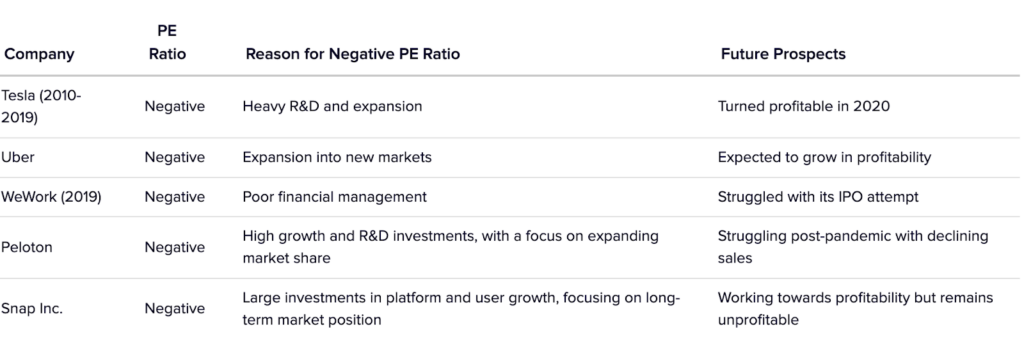

Below are some examples of companies that you’ve probably heard that have either had or have recently had a negative PE ratio.

Examples of companies with Negative PE ratios

You might notice that Tesla is on that list, and if you invested in Tesla in 2010, 2011, or 2012, you stand to have made a considerable return, to say the least. Some of the other companies that once had a negative PE ratio you also might have heard of

- Amazon

- Netflix

- Shopify

- Uber

Everyone wants to know which company with a negative PE ratio stands to reap serious rewards in the future thanks to smart planning in investment. Most people will want an expert opinion on where to look and as experts in various industries and knowledge of how the nuts and bolts of company financials work, we have you covered.

Why does a company have a negative PE ratio?

A company has a negative PE ratio when it’s reporting a financial loss, meaning its earnings are in the red. This can happen for several reasons, such as being a startup or high-growth company that’s heavily investing in expansion, new products, or research and development. These businesses often prioritize growth over immediate profits.

It can also happen during economic downturns or due to temporary issues like restructuring or one-time costs. In some cases, a negative PE ratio may signal deeper problems, like poor financial management or a declining market for the company’s products and services.

Tech startups

Tech startups often report negative PE ratios because they choose to reinvest their earnings back into the business instead of generating profits in the short term. These companies focus on rapid growth by expanding their operations, investing in new technologies, or acquiring more customers. This heavy spending can lead to losses for several years, even if the company is growing quickly.

The goal is to dominate the market or develop breakthrough technologies, with the expectation that profits will come later. Investors still support these businesses because they believe in the company’s long-term potential.

E-commerce

E-commerce companies frequently report negative earnings, especially during their growth phase. They tend to prioritize market expansion and customer acquisition over profitability in the early years. This means they often spend heavily on advertising, customer service, and logistical infrastructure to compete with larger retailers and increase their market share. The strategy is to gain a large base of loyal customers, with the assumption that profits will eventually follow. The large initial expenses typically lead to negative earnings, but the hope is that it pays off as the company scales.

Real Life Example

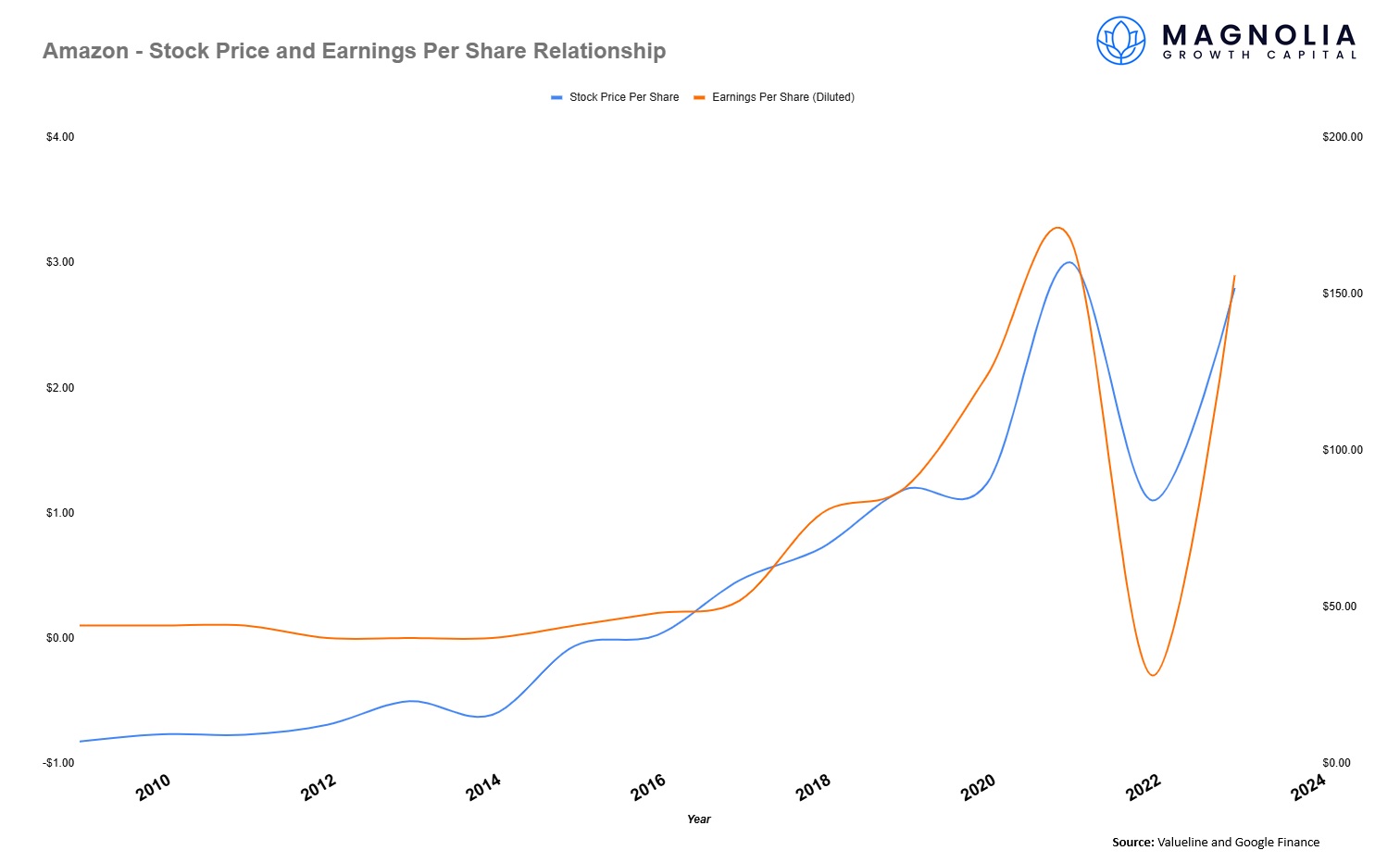

Amazon – Amazon has frequently reported negative earnings as it focuses on expanding its Cloud Services and investing in logistics and infrastructure to compete in the online retail space which is super competitive.

Biotech companies

Biotech companies regularly have negative PE ratios due to their massive investments in research and development. Developing new drugs or treatments can take many years, and even then, there’s no guarantee of success. Most of the company’s resources are spent on scientific research and clinical trials, which do not generate immediate revenue.

Since biotech firms often don’t have products on the market until the later stages of their growth, they usually operate at a loss for a long time. Despite these losses, investors may still see potential due to the high value of future successful drugs and the amount of ROI that can be made with smart bets on pharmaceutical products.

Real-life example:

Moderna (before COVID-19 vaccine) – Moderna, like many biotech firms, had a negative PE ratio while it invested in developing mRNA technology, which eventually led to their breakthrough with the COVID-19 vaccine.

Energy and commodity companies

Energy and commodity companies can face negative PE ratios due to the volatile nature of commodity prices and their substantial upfront investment in infrastructure. These industries are particularly affected by market fluctuations, where falling prices for oil, natural gas, or metals can lead to significant losses. These companies often take on large amounts of debt to finance exploration, mining, or drilling projects. During economic downturns or when commodity prices drop, these investments can lead to losses, driving down earnings and resulting in negative PE ratios.

Real Life Example: Chesapeake Energy

– Chesapeake Energy was famous for having a negative PE ratio during oil market downturns due to falling prices and over-leveraged investments in oil exploration.

There are several changes in these industries that many should probably be aware of. We can sit down and explain what’s changing, and where you should be looking for the future.

How to evaluate stocks with negative PE ratios

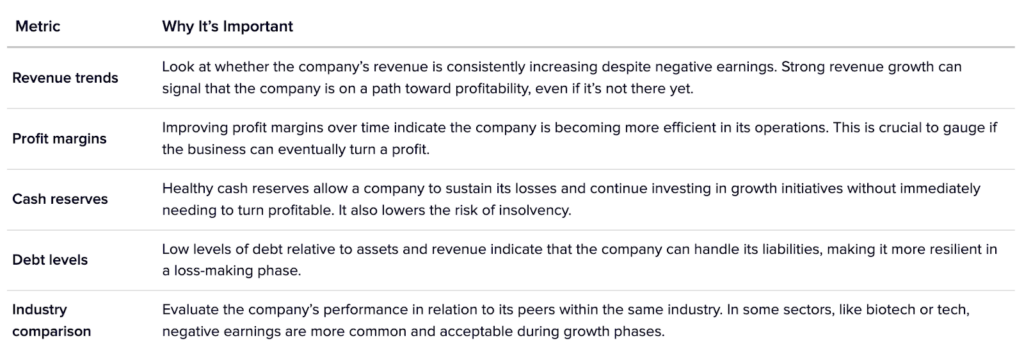

To evaluate stocks with negative PE ratios, focus on key things like revenue growth, improving profit margins, and cash reserves. These indicators show whether the company is on a path to profitability despite current losses. Comparing the company’s performance to industry peers also helps understand if the negative earnings are typical of the space or a red flag.

FAQ

Can a company with a negative PE ratio still be a good investment?

Yes, a company with a negative PE ratio can still be a good investment under certain circumstances. For example, if the company is in a high-growth phase (like many tech startups), it might be spending heavily on expansion or research, which could lead to future profitability. Investors might see potential in the company’s long-term success, especially if revenue is growing and the company has a clear path to turning profitable.

How do you compare companies with negative PE ratios in the same industry?

When comparing companies with negative PE ratios, focus on factors beyond the PE ratio itself, such as revenue growth, cash flow, and profit margins. Look at the company’s business model, market share, and whether it’s improving its financial health over time. It’s also useful to assess how long each company has been operating at a loss, and whether there are clear reasons for that (e.g., high R&D costs or market expansion).

Is there a point where a negative PE ratio becomes too risky for investors?

Yes, if a company continues to report negative earnings for an extended period without showing signs of improvement, it may become too risky for most investors. A prolonged negative PE ratio, particularly if revenue growth stalls or cash reserves dwindle, can signal deeper financial problems which is always considered a risk.