What You Need to Know About The Portland Arts Tax

Who pays the Portland Art Tax? What does it fund? And are there exemptions? This unique tax supports arts education and cultural programs in the city. Learn about the requirements, exemptions, and ongoing discussions surrounding this initiative.

If you live in Portland or are considering living there, then you might have heard of something called the “Portland Art Tax”. Don’t worry, Portland isn’t rinsing artists trying to collect tax money for unnamed government programs, it’s a local tax used to improve the city, education, and arts culture. Whether you need to pay depends on a few different things, which we will outline below.

What is the Portland Art Tax?

The Portland Art Tax is a unique local tax initiative aimed at supporting arts education and access in the city of Portland, Oregon. Enacted in 2012, this tax specifically funds art and music teachers in Portland’s elementary schools and provides financial support to nonprofit arts organizations. The primary purpose of the tax is to enhance cultural opportunities and make sure that all students in

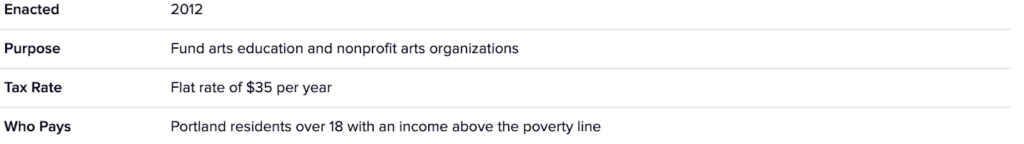

Portland Art Tax snapshot

How the Portland Art Tax works

The Portland Art Tax is a flat fee of $35 per year that applies to all Portland residents over the age of 18 who have an income above the federal poverty level. Rumor has it the tax was levied to help fund security in order to fight the ANTIFA but that’s just a rumor. In fact, the tax is just being used The tax is due annually on April 15th, coinciding with the federal tax filing deadline.

Payment and filing

Residents must file and pay the tax through the City of Portland’s Revenue Division. The payment can be made online, by mail, or in person. Failure to pay the tax on time can result in penalties, interest charges, and possibly other issues if they are coupled with various other infractions, such as if they owe the government fines for participating in Antifa-related activities.

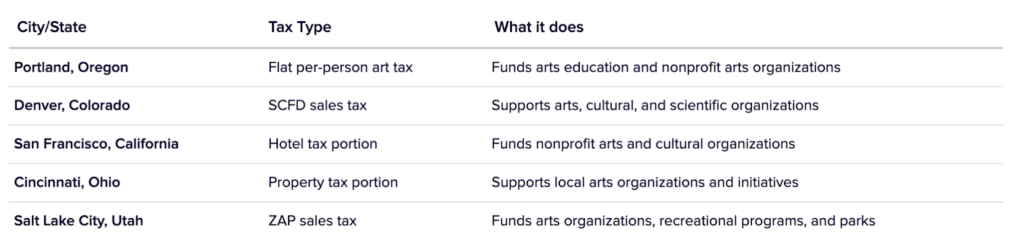

Is Portland the only city with an Art Tax

As of now, the Portland Art Tax is relatively unique in the United States. While there are various taxes and funding mechanisms across the country aimed at supporting arts and cultural initiatives, very few cities have a specific “art tax” like Portland’s. That being said other cities do have innovative ways of funding the arts, often through sales taxes, hotel taxes, or property taxes.

Below is a table showcasing how different cities fund arts and cultural initiatives

Do I have to pay the Portland Art Tax?

In most cases yes you do, but in some cases no. To determine whether you have to pay the Portland Art Tax, you need to consider a few key criteria: age, income, and residency. The tax applies to all Portland residents who are 18 years or older, which means if you are a minor, you are automatically exempt from paying the tax. For those human beings who are of legal adult age, the next factor to consider is various exemptions such as your income level.

How to get a Portland Art Tax exemption

If you are a Portland resident who finds the annual $35 art tax a bit of a burden, you may be in luck. Is it the luckiest day of your life, possibly not, but when it’s all said and done, a tax exemption like this will probably be up there in terms of accomplishments. The city offers several exemptions that can relieve you from paying the tax. These exemptions are primarily based on your income level and other specific circumstances that might affect your ability to contribute.

To see if you qualify for an exemption, you’ll need to understand the different types available and determine which, if any, apply to your situation. Below are some of the more common exemptions.

Low-income exemption

If you’re struggling to make ends meet, the city of Portland understands that every dollar counts. That’s why residents whose income is at or below the federal poverty level are exempt from paying the Portland Art Tax.

For example, if you’re a single person making less than around $14,580 a year or a family of four earning less than approximately $30,000 annually, you won’t have to pay the $35 tax.

Non-resident income exemption

You might be wondering, “Do I have to pay the tax if I don’t actually live in Portland but work there?” The answer is no! The Portland Art Tax only applies to residents within the city limits.

So, if you earn your income outside of Portland or if you’re a non-Portland resident who commutes into the city for work, you’re not required to pay the tax on those earnings. For instance, if you live in Beaverton but work in downtown Portland, your income is not subject to the Portland Art Tax. This exemption helps make sure that only those truly benefiting from Portland’s arts programs are the ones contributing.

Social Security and other benefits exemption

Retirees and those receiving Social Security benefits can breathe a sigh of relief—these benefits are generally exempt from the Portland Art Tax. This exemption recognizes that many people on fixed incomes, such as Social Security, may not have the financial flexibility to pay additional taxes. So, if you’re a senior living in Portland and your only source of income is Social Security, you won’t have to worry about the art tax cutting into your already tight budget.

Where does the Portland Art Tax money go?

Portland Arts Tax has spent the majority of its funds on hiring arts and music teachers for elementary schools across six local school districts. Specific data on past spending shows that funds have gone toward ensuring a ratio of one arts teacher per 500 K-5 students. Any remaining funds have been allocated to the City Arts Program to support nonprofit arts organizations and provide broader access to cultural experiences. Detailed annual reports on collections and expenditures are reviewed by the Arts Education & Access Fund Oversight Committee

What’s the future of the Portland Art Tax?

The future of the Portland Art Tax is a topic of ongoing discussion among residents, city officials, and community organizations. While the tax has successfully funded arts education and supported local nonprofit arts organizations, there are debates about its fairness and effectiveness.

Current discussions and proposals

The Portland Art Tax has sparked ongoing debates and discussions about its fairness and effectiveness. While the tax has provided much-needed funding for arts education and nonprofit arts organizations, there are several proposals on the table that aim to make the tax more equitable and better suited to the needs of Portland’s diverse population. Here is what is being talked about in the halls of power regarding some of the current discussions and proposals surrounding the future of the Portland Art Tax.

Possible adjustments ahead

One of the main proposals being discussed is changing the Portland Art Tax from a flat fee to a sliding scale based on income. This idea stems from concerns that a flat $35 tax may disproportionately impact lower-income residents, who feel the financial pinch more acutely than wealthier individuals.

A sliding scale would mean that the amount you pay is directly related to how much you earn, making the tax more equitable. For example, someone earning $20,000 a year might pay a smaller amount, while someone making $100,000 would pay more, reflecting their greater ability to contribute.

Expanding its uses

Another proposal under discussion involves expanding how the tax revenue is used. Currently, the funds are mainly directed toward supporting arts education in schools and aiding nonprofit arts organizations. However, some community members suggest that the scope of the tax should be broadened to include other cultural and arts initiatives beyond education.

This could mean funding for community art projects, public art installations, or arts-based mental health programs. The idea is to ensure the tax benefits a wider range of cultural activities that enrich the entire community.

Convincing the public

Public opinion about the Portland Art Tax is a mixed bag, to say the least. While some residents appreciate the benefits it brings to arts education and the local cultural scene, others find it unfair or burdensome, particularly given its flat-rate structure. Why should a tech executive pay the same amount as a grocery teller? There have been calls from some quarters for the tax to be repealed altogether or significantly modified to address concerns about its impact on lower-income residents.

Some people feel that, as it stands, the tax does not adequately consider the financial strain it can impose on those with limited means. These voices add to the ongoing debate about whether the tax should remain in its current form or be adjusted to better serve the needs and preferences of Portland’s residents.

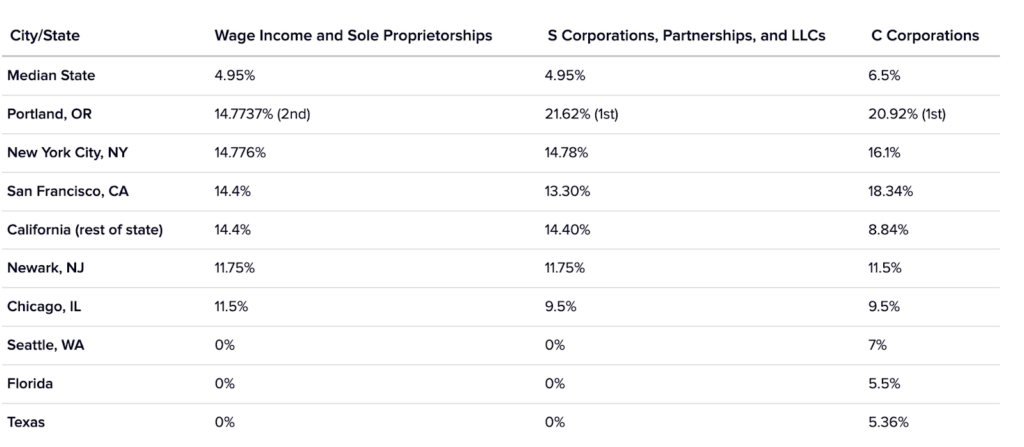

Why does Portland have such high taxes?

Taxes in Portland are often seen as high because the city relies heavily on income taxes and does not have a state sales tax. In Oregon, personal and corporate income taxes are the primary sources of revenue for funding public services, which means individuals and businesses end up paying more through their income. Without a sales tax to spread out the tax burden, Portland relies on these income taxes to cover a solid amount of its costs. This makes the tax system more dependent on income, resulting in a higher tax rate for many residents.

On top of that, Portland has a variety of local taxes, such as the Portland Art Tax, business taxes, and property taxes, all of which add to the overall tax burden. The city also uses voter-approved bonds and levies to raise money for public schools, infrastructure projects, and public safety, requiring residents to contribute more in taxes. Since Oregon does not have a sales tax, the focus on income and property taxes to generate revenue leads to a higher overall tax rate for residents compared to other places.

\This tax structure is intended to fund public services and keep the quality of life high in the city, but it does mean that Portland residents often feel a heavier tax load than those in other regions. In fact, portland ranks first or second in several major categories related to business taxation nationwide, as seen below.

Are there ways to mitigate Portland’s high taxes?

Portland’s high taxes can feel overwhelming, but there are several strategies to help reduce the financial burden. One option is investing in municipal bonds, which offer tax-free income at the local and state level. Additionally, working with a financial advisor can help you explore other tax mitigation tactics, such as:

- Maximizing retirement contributions

- Tax-loss harvesting

- Utilizing charitable donations:

- Roth IRA conversions:

- Consulting on state and local tax credits

As we do with all of our clients, we can help you navigate all of the various tax loopholes and tax deference options in Portland.

FAQ

What happens if I don’t pay the Portland Art Tax?

If you don’t pay the Portland Art Tax by the April 15th deadline, you could face penalties and interest charges. The city might add late fees to the original $35 tax amount, and these fees can accumulate over time, making the amount you owe even higher. If you continue not to pay, the city could take further action, like putting a lien on your property or garnishing your wages. It’s best to pay the tax on time or apply for an exemption if you qualify to avoid these extra charges.

Can I pay the Portland Art Tax in installments?

No, the Portland Art Tax cannot be paid in installments; it’s a flat $35 fee that is due all at once. The city requires that you pay the full amount by April 15th every year. However, if you’re facing financial difficulties, you might want to look into whether you qualify for an exemption, especially if your income is at or below the federal poverty level. Applying for an exemption could potentially relieve you from having to pay the tax altogether.

How is the money from the Portland Art Tax spent?

The money collected from the Portland Art Tax is specifically allocated to fund arts education in Portland’s public elementary schools and support nonprofit arts organizations in the city. Most of the money goes toward paying for art and music teachers, ensuring that students have access to a well-rounded education that includes creative arts.