It’s been said that the sum of all human experience can be reduced to, ‘This too will pass.’

This ancient wisdom offers a helpful perspective as we observe the stock market’s inherent ups and downs.

The stock market has been going through a rough patch lately, with worries about trade tariffs causing prices to drop. This might feel like a repeating pattern, especially since the technology sector has been hit hard. Some investors might wonder if the market will ever settle down. What should everyday investors do during these uncertain times?

Think of the market like the weather – it has natural cycles of good and bad periods. Just like winter eventually turns to spring, market downturns have historically given way to better times. While current concerns about trade disputes make this situation unique, looking at past events suggests that markets tend to recover once uncertainty clears up.

When markets fall, recovery often happens when we least expect it

The S&P 500, a measure of the largest U.S. companies, has fallen about 10% from its highest point – what investors call a “correction.” The Nasdaq, which includes many technology companies, has been down for almost a month.1 This uncertainty has caused big swings in stock prices, with some days seeing significant drops.

There’s a saying that markets take the stairs up but the elevator down. This means that growth in the market usually happens slowly over time, while drops tend to happen quickly, like we’ve seen this year. However, even when markets hit new low points, these lows are often higher than previous high points from years past. It’s like climbing several flights of stairs before taking the elevator down one floor.

This helps us understand today’s situation. While the market has dropped from its February peak, it’s only back to where it was last September. So while the decline isn’t pleasant, it helps to look at the bigger picture.

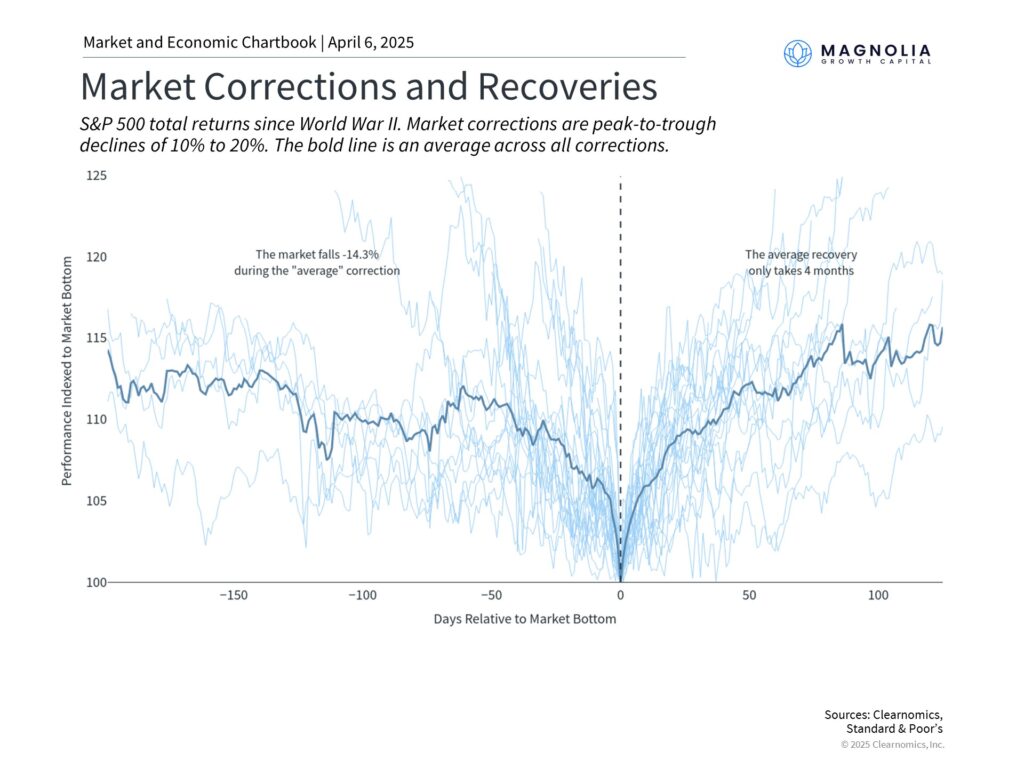

The chart shows that market corrections happen regularly and typically drop about 14.3% since World War II. Despite these drops, markets have historically recovered within a few months, often bouncing back when people least expect it. We’ve seen this happen many times – during the pandemic in 2020, after the technology stock decline in 2022, during the banking concerns in 2023, and many other times.

Trying to time market ups and downs often backfires

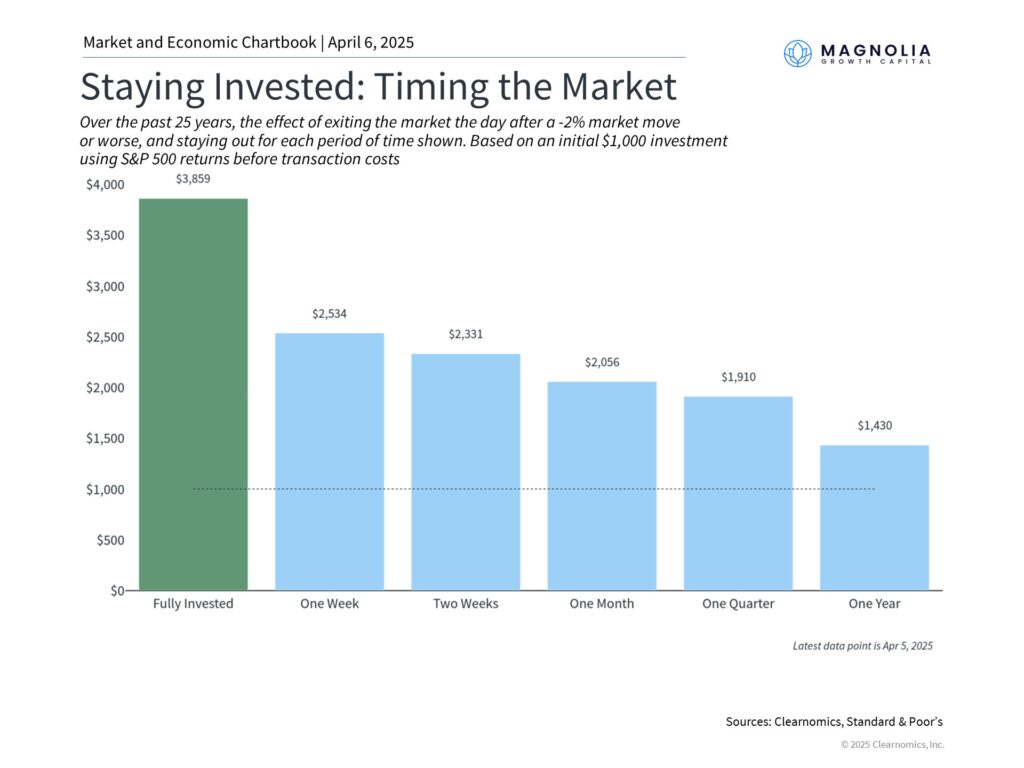

The famous investor Peter Lynch once wrote that “far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” When markets go up and down, some investors try to avoid losses by moving their money in and out of stocks. However, this strategy often doesn’t work well. Investors who try to wait for the “right time” to invest often miss the early stages of recovery. The chart shows what happens to investment returns when investors try to time the market over 25 years.

While everyone would like to avoid bad market days, doing this consistently is extremely difficult. Even if someone could perfectly avoid both the best and worst days – which is nearly impossible – they would only do slightly better than someone who stayed invested the whole time. Most investors react after market moves have already happened, which can hurt their long-term results.

Understanding reciprocal tariffs and stock returns

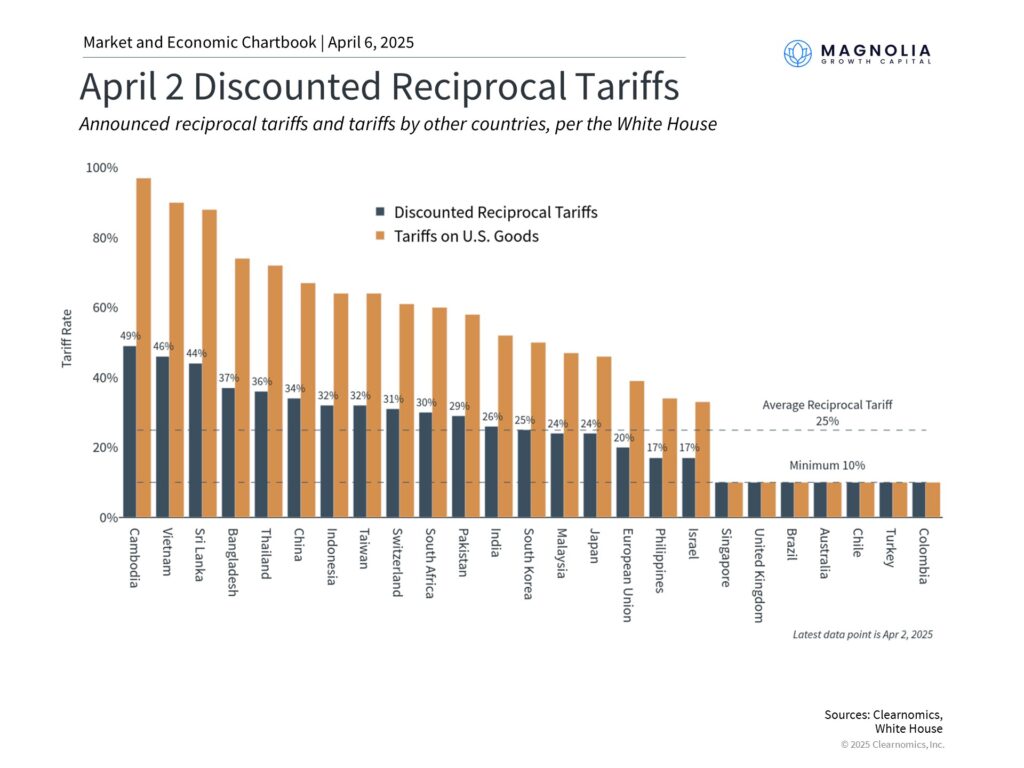

On April 2, 2025, the White House announced new reciprocal tariffs against major trading partners. These tariffs are “discounted” from fully reciprocal tariffs, representing about half of what other countries charge on U.S. goods. While these rates are higher than many expected, the fact that they would be implemented was widely telegraphed.

Investors are trying to understand how new tariffs might affect the economy. These tariffs are often used in negotiations about various issues, including immigration. Already, concerns about higher prices have affected how consumers feel and raised worries about inflation. If trading partners respond with their own tariffs, it could slow down economic growth.

While there’s uncertainty about how tariffs will work out, their full impact takes time to understand. It takes many months to see how companies adjust their business practices, whether they absorb higher costs or pass them to customers, and how other countries respond.

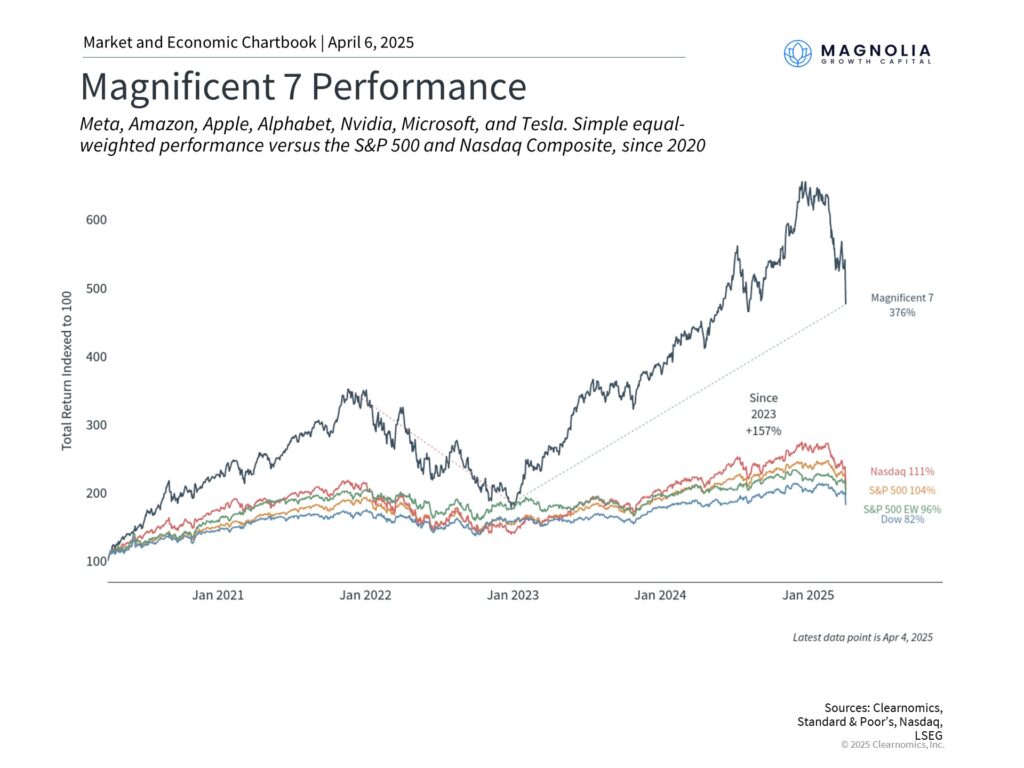

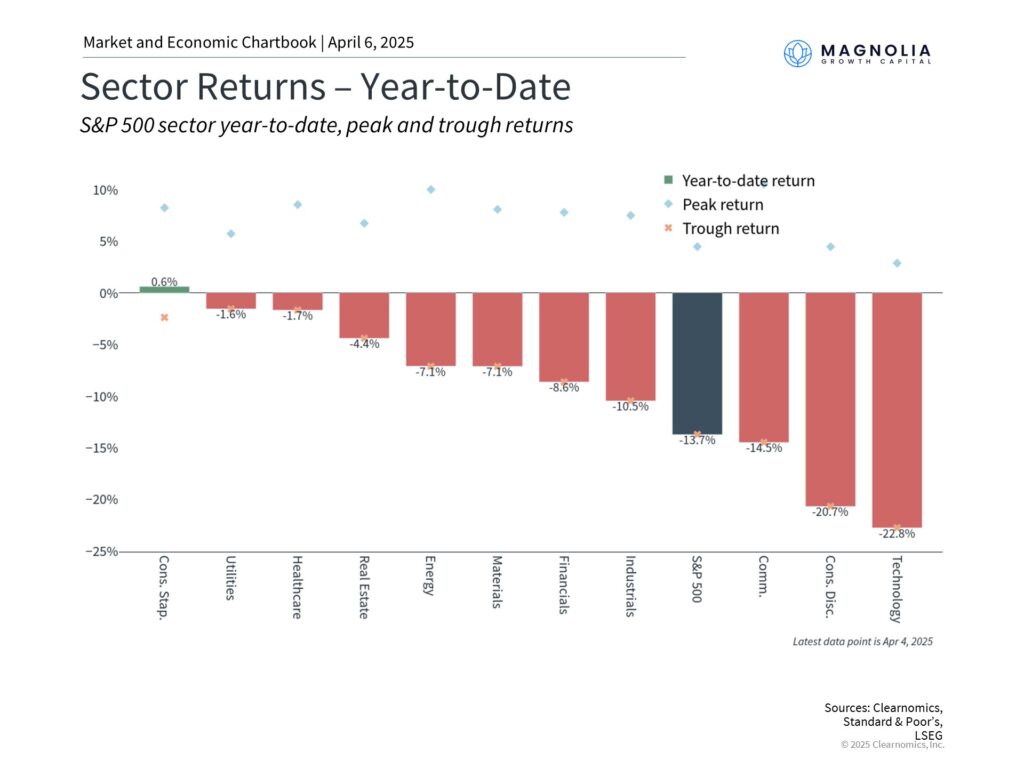

Meanwhile, technology stocks, which led the market higher in recent years, have fallen the most, as shown in the chart. The Magnificent 7 stocks had risen significantly before this decline. These big swings up and down are exactly what investors mean when they say certain stocks are more volatile.

However, many other sectors have fared better recently, including consumer staples, healthcare, and utilities. Over the past year, most market sectors have still made money despite recent swings. This shows why it’s important to spread investments across different types of companies.

The bottom line? While markets have become more volatile due to tariff news and technology stocks have struggled, history shows that staying focused on long-term goals is still the best approach to investing.

1S&P 500 declined 9.2% between February 19, 2025 and March 28, 2025. The Nasdaq fell 14.1%, between December 16, 2024 and March 28, 2025

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision. Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication. The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Magnolia Growth Capital LLC (referred to as “MGC”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose. All opinions and estimates constitute MGC’s judgement as of the date of this communication and are subject to change without notice. MGC does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall MGC be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if MGC or a MGC authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.