Investing in Fixed Income: A Guide for Savvy Investors

Fixed-income investing offers a reliable way to generate steady income with lower risk than stocks. By diversifying across various bond types like government, corporate, and municipal bonds, investors can create a portfolio that matches their risk tolerance and financial goals. While interest rate changes and inflation pose potential risks, careful planning and professional guidance can help maximize the benefits of fixed-income investments for a secure financial future.

Build a portfolio that works for you, even while you’re not working on it. Income investing provides consistent returns and peace of mind, allowing you to pursue your passions knowing your finances are secure.

What is fixed-income investing?

Fixed-income investing refers to investing in securities that offer regular interest payments, usually in the form of bonds. In return for lending money to the bond issuer—whether it’s a government, corporation, or municipality—the investor receives fixed interest payments (known as coupon payments) over the bond’s or securities life. When the bond or security matures, the investor is repaid the security’s face value.

The primary objective of fixed-income investing is to provide steady, reliable income with lower risk than equity investing. These investments are generally favored by retirees or investors looking to preserve their wealth and avoid high volatility.

Examples of fixed income investments

As mentioned above, a fixed income investment revolves around fixed interest payments over a fixed period of time at regular intervals. Here are the most common types of fixed-income assets to consider:

Government bonds

Government bonds are issued by national governments and are considered one of the safest ways to invest. Everyone on planet earth knows that U.S. Treasury bonds are very popular because they are backed by the U.S. government, which makes them extremely low-risk. Government bonds come in different shapes and sizes: short-term bonds like Treasury bills that mature in less than a year, and long-term bonds like 10-year Treasury bonds. While they don’t offer high returns, they provide steady interest payments and are ideal for those looking for safety and reliability.

Corporate bonds

Companies issue corporate bonds to raise money for business activities like expansion or new projects. These bonds usually offer higher returns than government bonds because there’s a greater risk of the company defaulting. The safety of corporate bonds depends on the company’s credit rating. Investment-grade bonds, like those issued by companies with strong credit ratings, are safer and offer lower returns. On the other hand, high-yield bonds (also known as “junk” bonds) come from companies with lower credit ratings, offering higher returns but with a higher risk of default.

Municipal bonds

Municipal bonds, or “munis,” are issued by local governments or municipalities to fund public projects like schools, roads, or hospitals. One of the main attractions of municipal bonds is that the interest earned is often exempt from federal taxes and, in some cases, state and local taxes as well. This can be a monster of a benefit for investors in higher tax brackets who want to reduce their tax burden. Municipal bonds generally offer lower yields than corporate bonds, but the tax advantages can make them a solid choice for certain investors.

Certificates of Deposit (CDs)

Certificates of Deposit, or CDs, are savings products offered by banks and credit unions. When you buy a CD, you agree to lock in your money for a set period, and in return, the bank pays you a fixed interest rate. CDs are very low-risk, as they are usually insured by the government up to a certain amount (in the U.S., up to $250,000 through the FDIC). The downside is that you can’t access your money until the term ends, which could range from a few months to several years. In return for this commitment, CDs usually offer slightly higher interest rates than regular savings accounts.

Bond mutual funds and ETFs

Bond mutual funds and Exchange-Traded Funds (ETFs) allow investors to buy a diversified basket of bonds in one investment. These funds spread their investments across many different types of bonds, such as government, corporate, or municipal bonds, which helps reduce risk. Bond funds are managed by professionals, so investors don’t need to pick individual bonds themselves. They provide regular income in the form of interest payments, making them a convenient option for those who want exposure to bonds without managing each investment.

Preferred stock

Preferred stock is a unique hybrid between bonds and common stocks. Like bonds, preferred stocks pay fixed dividends, which are similar to interest payments, making them a popular choice for income-focused investors. However, unlike bonds, preferred stocks can increase in value, providing the potential for price appreciation. While preferred stocks typically offer higher payouts than common stocks, they come with less voting power and are riskier than traditional bonds because the dividends are not guaranteed in times of financial difficulty for the company.

How interest rates affect bonds

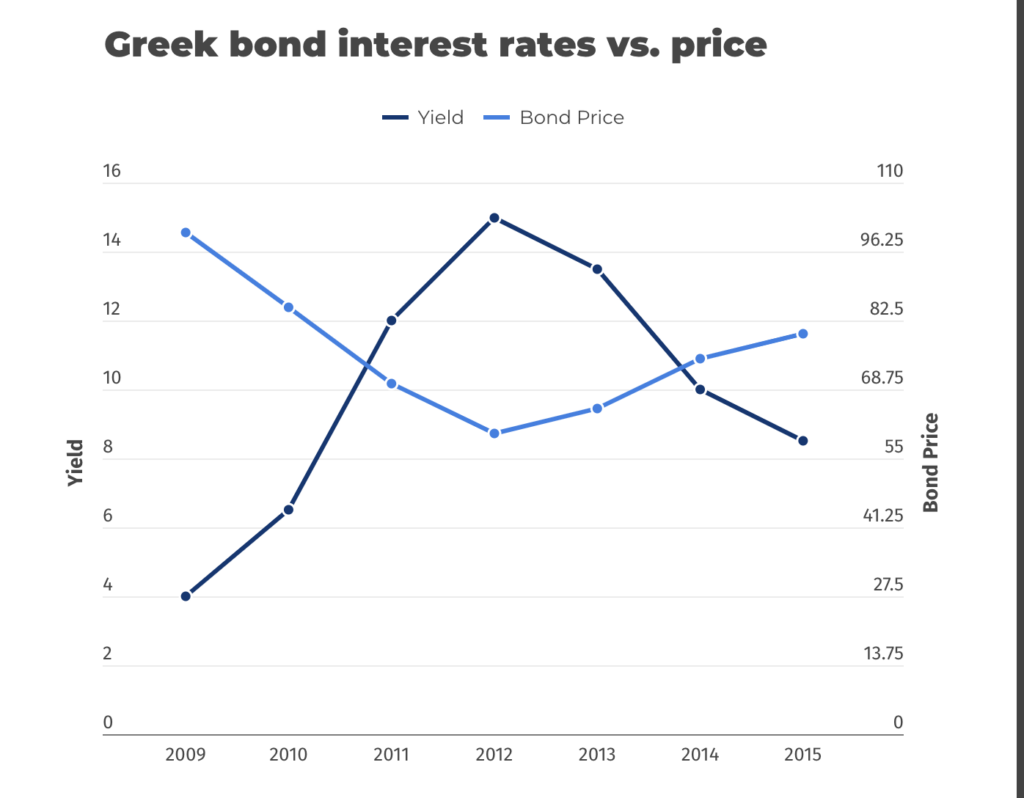

When interest rates go up or down, it affects the value of bonds. Think of it like this: if you buy a bond that pays a fixed interest rate, and then interest rates in the market go up, new bonds being issued will pay more interest. That makes your bond less attractive because it’s paying a lower rate than the new ones, so its value goes down if you want to sell it. On the flip side, if interest rates go down, your bond becomes more valuable because it’s paying a higher interest than new bonds.

Below is an example of the Greek debt crisis, in which you can see the correlation between bond prices and interest rates. As the interest rates rise, the bond prices fall, and vice versa.

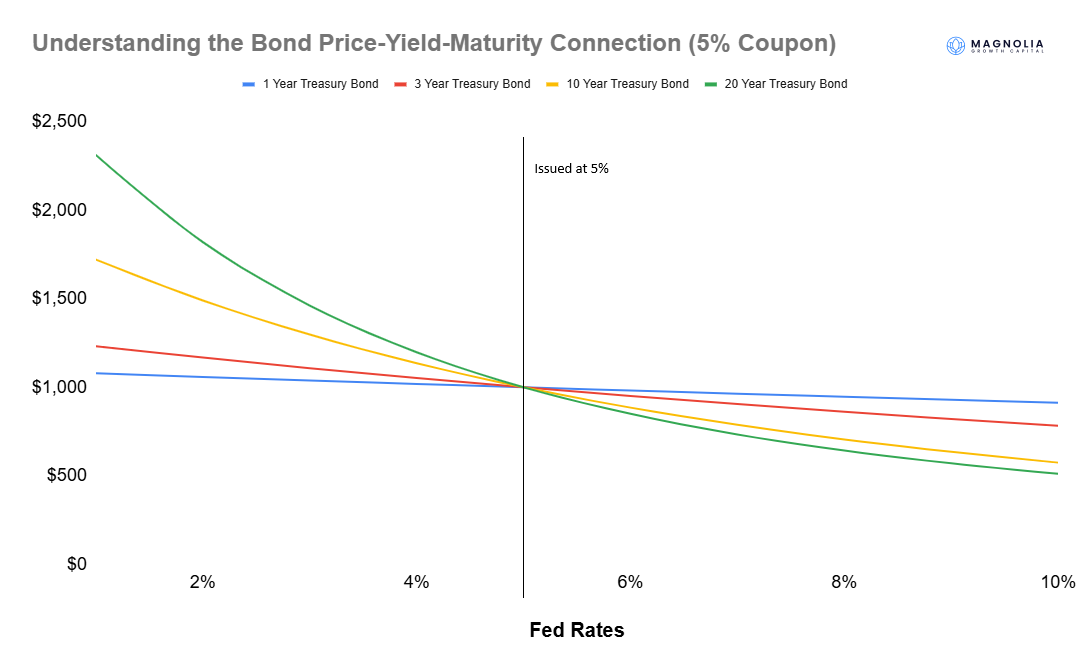

Now, the effect is bigger or smaller depending on how long the bond lasts (its duration). Shorter-term bonds, like 3-month or 6-month bonds, are less affected by changes in interest rates because they mature quickly, and you can reinvest at the new rates soon. Longer-term bonds are more sensitive to rate changes because you’re locked into that lower or higher rate for a longer time.

Each person needs a different bond strategy that’s tailor-made to their financial goals and investment horizons, while taking into account the interest rate environment. We have experience sitting down with clients and developing a comprehensive strategy for investment with this type of timeline in mind.

How bond duration affects bond price

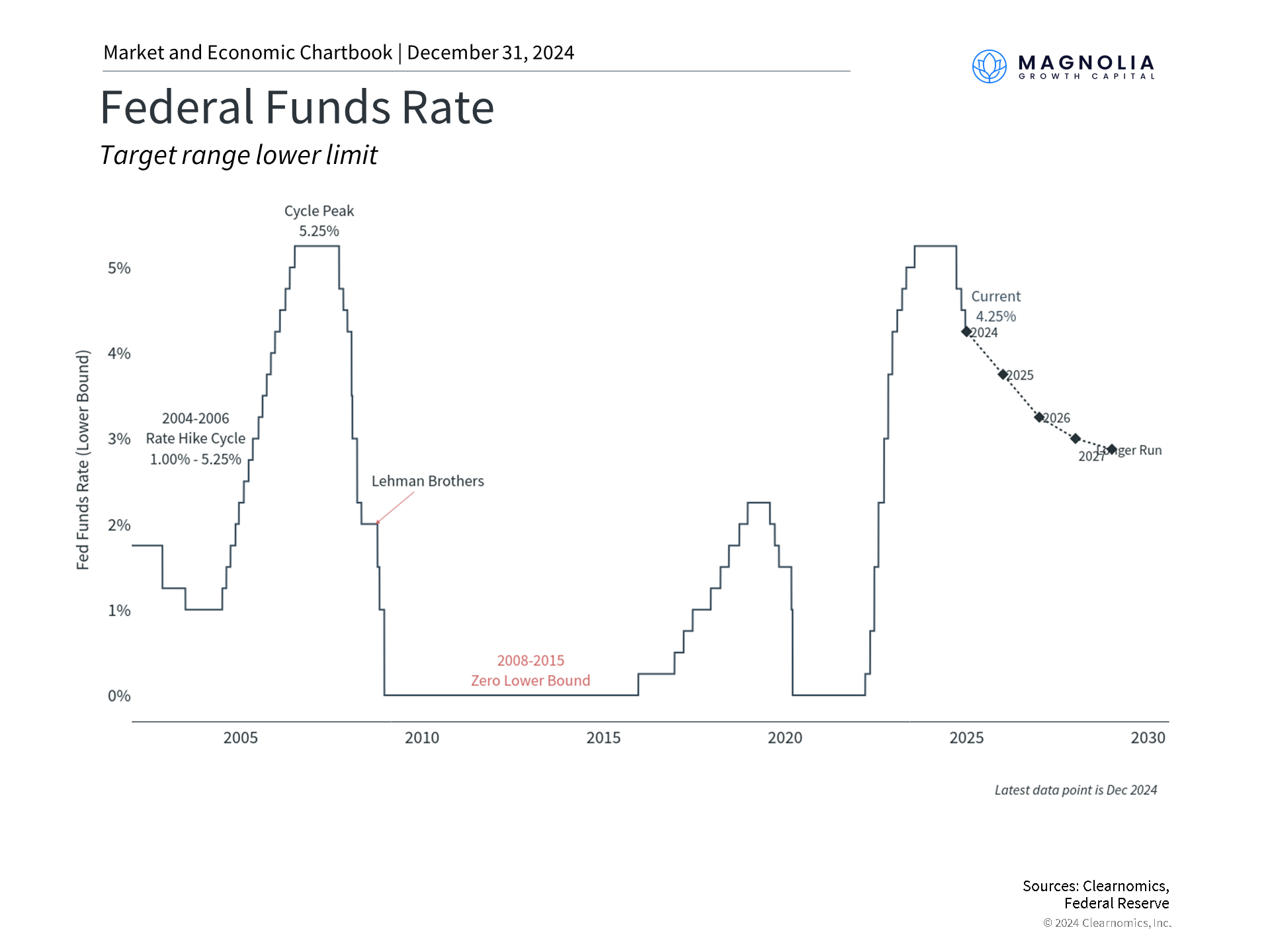

The Federal Reserve (Fed) is currently navigating a rate cut cycle, but predicting the exact path of future cuts is like trying to read tea leaves. Even expert investors have differing opinions on how much and when the Fed will adjust rates in 2025. The chart below illustrates the Federal Funds Rate lower limit and projections from the Federal Open Market Committee (FOMC).

So, how does this affect your bond investments? This is where understanding “duration” becomes crucial.

Think of bond duration as a measure of a bond’s sensitivity to interest rate changes. The chart below shows how bond prices react to different interest rates (Fed rates) depending on their duration (maturity). As you can see, the longer the duration, the steeper the line, meaning greater price swings!

- Longer duration bonds (like the 20-year Treasury bond): Offer higher potential returns but come with increased risk, as their prices are more sensitive to interest rate changes.

- Shorter duration bonds (like the 1-year Treasury bond): Provide more stability but may have lower potential returns.

Finding the right mix of bond durations is key to building a portfolio that matches your risk tolerance and financial goals. We can help you navigate these uncertain times and create a strategy that works for you. Contact us today for a personalized consultation.

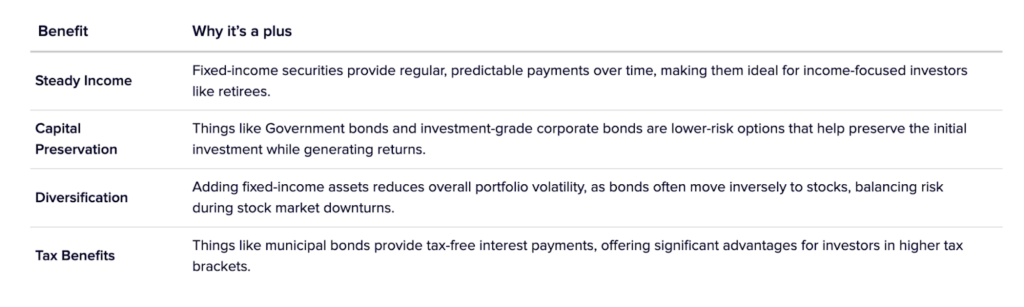

What are the benefits of fixed income investing? There’s a few

Income investing offers several advantages, particularly for those seeking a stable and predictable return. One of the main benefits is the regular income stream it provides, which can be ideal for retirees or anyone looking for consistent cash flow. It also tends to preserve capital, especially with lower-risk options like government bonds, making it a safer bet compared to stocks. On top of everything, income investments can help diversify a portfolio, reducing volatility during market downturns. For some investors, there are even tax advantages, such as with municipal bonds that offer tax-free interest payments as mentioned above.

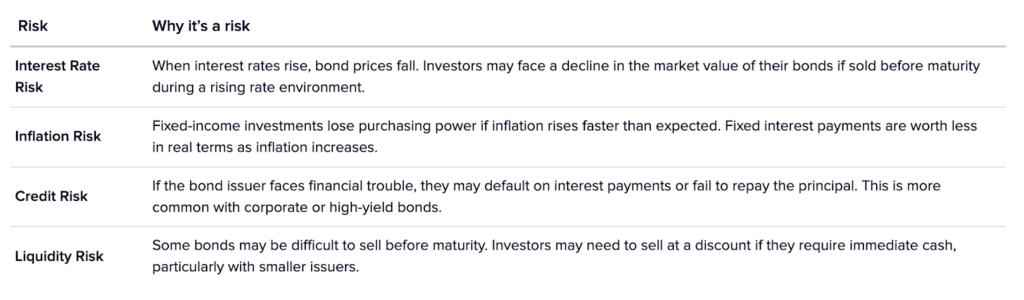

Why there can be risks with fixed income investing

Income investing is not without its risks, even though it’s often considered safer than investing in stocks. While the goal is to generate steady cash flow, various factors can still impact your returns. Things like rising interest rates, inflation, or the issuer’s financial health can cause your investments to lose value.

Fixed Income vs. Equity Investing

Fixed-income investing differs from equity investing primarily in the risk-return profile. Equity investing offers the potential for higher returns but with increased risk and volatility. Fixed-income securities provide stable, predictable returns but with less opportunity for capital appreciation.

An investor might use both strategies to balance their portfolio, depending on their risk tolerance and investment goals. For instance, younger investors might favor equity investing for long-term growth, while retirees might lean towards fixed-income investments for security and income.

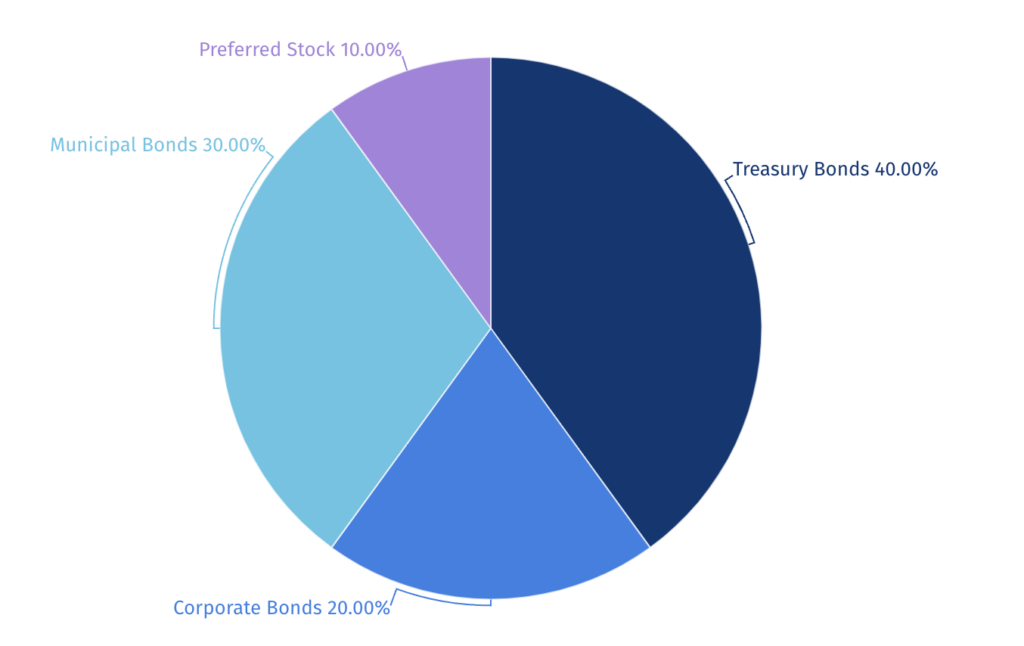

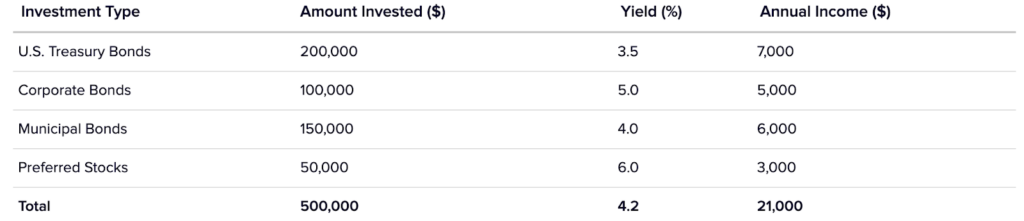

Fixed-Income Example Portfolio: Mr. Lee’s Retirement

We spoke to a client recently who we will call “Mr. Lee,” a 50-year-old professional who plans to retire in 10 years. He wants to create a portfolio that generates $30,000 annually in fixed income to supplement his retirement. He has $500,000 to invest and aims for a 6% annual yield. Here’s how he could structure his his fixed-income portfolio:

$200,000 in U.S. Treasury Bonds

Mr. Lee allocates 40% of his portfolio to 10-year U.S. Treasury bonds yielding 3.5%. While the yield is relatively low, the safety of government bonds appeals to him.

Yield: 3.5%

Annual Income: $7,000

$100,000 in Corporate Bonds

He chooses investment-grade corporate bonds offering a 5% yield. This portion of the portfolio provides a balance between risk and return.

Yield: 5%

Annual Income: $5,000

$150,000 in Municipal Bonds

Mr. Lee invests in municipal bonds to take advantage of the tax-free income. These bonds offer a 4% tax-free yield, appealing given his high tax bracket.

Yield: 4%

Annual Income: $6,000

$50,000 in Preferred Stocks

For higher yields, he places a portion in preferred stocks offering a 6% yield. While riskier than bonds, the fixed dividend payments align with his income needs.

Yield: 6%

Annual Income: $3,000

Total Portfolio Yield: 4.2%

Annual Income: $21,000

Mr. Lee’s current fixed-income portfolio generates $21,000 annually, which is slightly below his goal of $30,000 in yearly income. However, this shortfall can be made up through a combination of his personal savings and social security benefits, which many retirees rely on to supplement their income. Social security provides a steady stream of payments based on your work history and earnings, and Mr. Lee likely qualifies for these benefits by the time he retires.

In addition to social security, Mr. Lee can draw from his other savings or investments, such as a 401(k) or IRA, to bridge the gap. These sources of income, along with his fixed-income investments, give him a more well-rounded and secure financial plan for retirement.

Is it possible to have too much fixed-income exposure in your portfolio?

Yes, it is possible to have too much fixed-income exposure in your portfolio. While fixed-income investments like bonds are considered safer and provide steady income, they also tend to offer lower returns compared to stocks or other growth investments. If your portfolio is too heavily weighted in fixed income, you could miss out on growth opportunities, especially if you’re still a long way from retirement.

Think of it like this: just like having too much of any one thing—whether it’s sugar, exercise, or even sleep—can be bad for you, having too much fixed income could leave your portfolio unbalanced. If inflation rises, the purchasing power of your fixed-income returns might not keep up, meaning you could end up with less buying power over time. Plus, you might be overly conservative, which limits your ability to grow your wealth in the long run.

A balanced approach, with a mix of fixed income, stocks, and other investments, helps you manage risk while still giving your portfolio a chance to grow.

FAQ

How do interest rates affect fixed-income investments?

When interest rates rise, the market value of existing fixed-income investments like bonds typically falls. This happens because new bonds are issued with higher interest rates, making older bonds with lower rates less attractive. If you hold bonds until they mature, you won’t lose any principal, but if you sell them before maturity, their market value could be lower.

Can fixed-income investments lose money?

Yes, although fixed-income investments are considered safer, they are not risk-free. If a bond issuer defaults, you could lose your investment. Also, rising interest rates or inflation can erode the value of your bonds, especially if you sell them before they mature.

Are fixed-income investments good during inflation?

Fixed-income investments can struggle during periods of high inflation because the fixed interest payments lose purchasing power. Inflation makes each dollar you receive worth less, which can erode your returns over time. Some investors may opt for inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), to mitigate this risk.