How Sequence of Returns Risk Can Derail Your Retirement

For many Baby Boomers, sequence of return risk poses a serious threat. Early losses while withdrawing funds can severely impact a portfolio’s longevity. Even with the same average return, the order in which those returns occur can drastically change retirement outcomes.

What is the Sequence of Returns Risk?

A large portion of the baby boomer generation, those born between 1946 and 1964, are either in the early stages of retirement or preparing to transition out of the workforce. For these individuals, the risk of experiencing significant and sustained investment losses while needing to draw on their savings for everyday expenses poses a serious threat.

This is what financial experts call “sequence of return risk.”

As one expert put it, “Early losses while withdrawing funds can severely impact a portfolio’s longevity.” Sequence of return risk, in essence, is the danger of encountering major investment losses early in retirement, precisely when retirees begin making regular withdrawals.

It’s a major, yet often underestimated, risk to retirement security.

This risk is particularly acute when retirees hold a large portion of their portfolio in stocks and then face a prolonged market downturn while taking regular withdrawals. The problem is that the investments decline, and selling assets in a down market further shrinks the portfolio.

So, even when the market eventually recovers, the remaining investments may not be sufficient to bring the portfolio back to its pre-downturn level.

The Tale of Two Retirements

Okay, so picture this: we’ve got Pam and Bob. They’re both ready to kick off their retirement, and they’ve both been pretty good about saving. In fact, over their 30 years of investing, both Pam and Bob’s portfolios have earned the same average return – 6% a year. Sounds great, right? You’d think they’d be in the same boat, ready to enjoy their golden years equally.

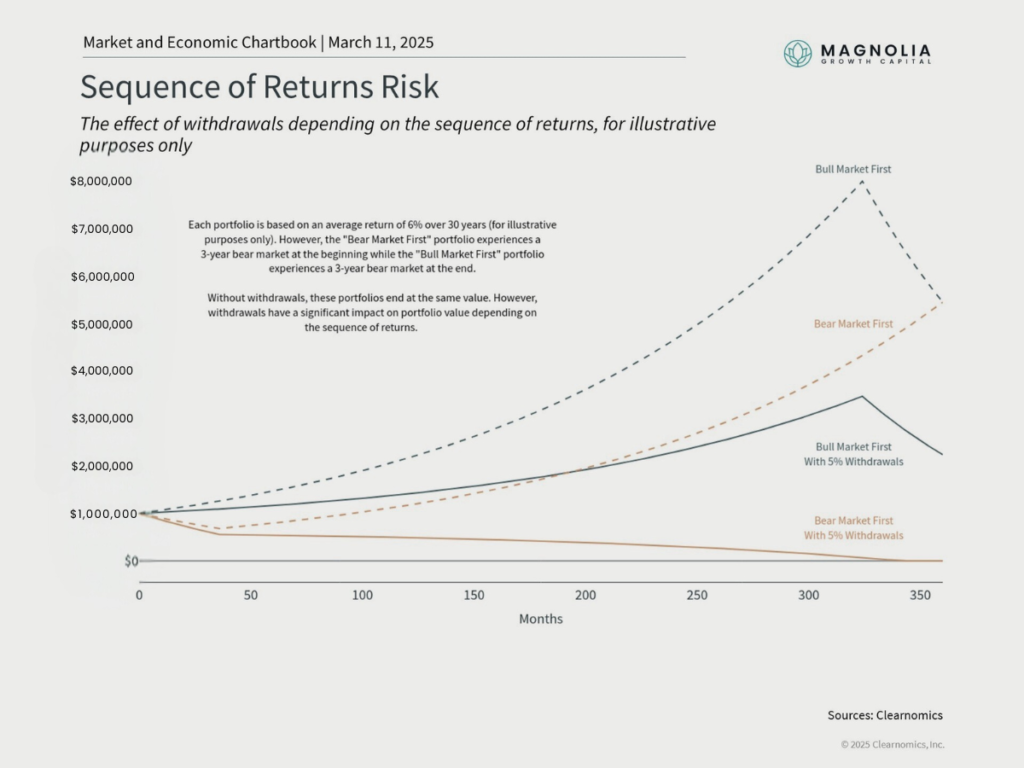

But here’s where things get interesting, and where our chart comes in handy. It shows us two different scenarios, and these scenarios are like Pam’s and Bob’s experiences.

In one scenario, let’s say it’s Pam’s, she experienced a “Bull Market First.” Think of it as her portfolio got off to a fantastic start right before she retired. The market was doing great, her investments were growing – it was smooth sailing early on.

In the other scenario, that’s Bob’s experience. He had a “Bear Market First.” Unfortunately, just as Bob was about to retire, the market took a downturn. His portfolio took a hit right at the beginning of his retirement.

Dotted Lines: These lines show how Pam and Bob’s portfolios would have grown if they hadn’t taken any money out. If they just left their investments alone, both Pam and Bob would have ended up at the same place after 30 years. This just proves that they both had that same average 6% return. So far, so good, right?

Solid Lines: But here’s the kicker, and this is where the solid lines come in. These show what happens when Pam and Bob start taking money out of their portfolios – let’s say they’re both taking out 5% each year to live on.

Look at Bob’s line, the orange solid one. Remember he had the “Bear Market First.” His portfolio takes a serious nosedive. Those early losses, right when he started relying on his savings, really hurt him. It becomes much harder for his investments to recover after that initial drop.

Now, look at Pam’s line, the blue solid one. She had that “Bull Market First.” Even with taking out the same 5% as Bob, her portfolio still grows over time. That strong start gave her a buffer, and her investments had more room to recover from any later downturns.

The bottom line is, even though Pam and Bob had the same average return, the order in which they experienced those returns made a HUGE difference in their retirement outcomes. And the chart’s timeline, that X-axis showing the months, really drives home how these early market conditions can have long-lasting effects on someone’s retirement.

It’s a powerful lesson about how important it is to consider not just average returns, but also the potential risks of market volatility, especially as you approach and begin retirement!

Why Now is a Critical Time

The current market volatility, driven by recession fears and trade war uncertainties, is a stark reminder of this risk. As Suzanne Woolley from Bloomberg points out, “The $5 Trillion Stock Wipeout Is Rattling America’s Big Spenders.” If this selloff persists, it could have severe economic consequences as Baby Boomers may be forced to spend less, or sell off more assets, to meet their living expenses.

Strategies to Mitigate Sequence of Returns Risk

While extended market downturns are relatively rare, it’s crucial to be prepared. Here are some strategies to mitigate sequence of returns risk:

Diversification

Maintain a balanced portfolio, such as a 60/40 split between stocks and bonds.

Source: Morningstar

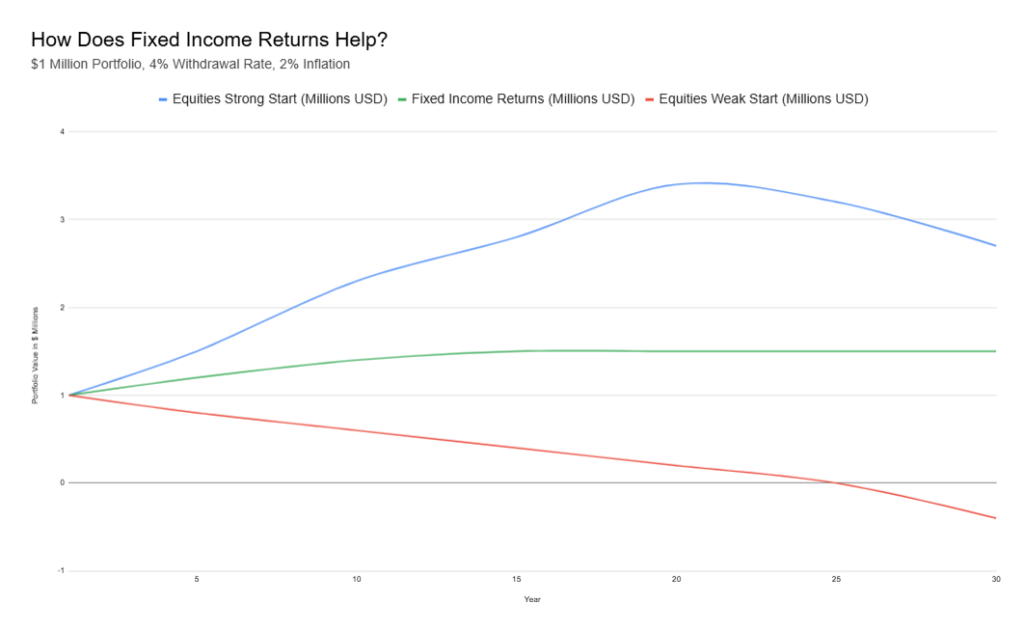

A portfolio heavily concentrated in equities can suffer drastically if a downturn occurs early in retirement. However, the green line (‘Fixed Income Returns’) shows the stability that fixed income can provide. While it doesn’t offer the same growth potential as equities in a bull market (blue line – ‘Equities Strong Start’), it provides a buffer against losses, which is crucial for mitigating sequence of returns risk.

Dynamic Withdrawal Strategies / Guardrails Approach

Dynamic withdrawal strategies and the guardrails approach are essential for adapting to market fluctuations. The chart illustrates the danger of a fixed withdrawal rate during a market downturn (red line). If withdrawals remain constant while the portfolio shrinks, it accelerates losses and jeopardizes long-term sustainability. Dynamic strategies address this by suggesting reducing withdrawals when the market is down. Conversely, in years mirroring the blue line’s strong growth, one might consider increasing withdrawals moderately, as these strategies suggest.

Bucket, Ladder, or Dumbbell Strategy

Divide your investments into buckets based on when you’ll need the money. Short-term expenses can be covered by safe assets like Treasury bills, while long-term growth can come from riskier investments.

TIPS

Consider buying Treasury Inflation-Protected Securities (TIPS) for the first five years of retirement and protect against inflation risk.

Conclusion

Careful planning is key to mitigating Sequence of returns risk, especially during volatile market periods. By understanding this risk and implementing sound strategies, we can help you protect your portfolio and ensure a more secure retirement. Don’t hesitate to contact us. The time is now.