How to Integrate Taxes and Legacy Planning in Your Retirement Planning

Planning for a secure retirement requires careful consideration of withdrawal strategies, such as the 4% rule, and understanding how market volatility and sequence of returns risk can impact your portfolio’s longevity. By integrating tax planning, legacy planning, and personalized investment strategies, you can optimize your retirement income and potentially leave a lasting legacy for future generations.

Understanding Sustainable Retirement Withdrawals in Today’s Market

As more Americans prepare to enter retirement, a crucial question looms: how can they ensure their nest egg lasts throughout their golden years? With evolving market conditions, economic shifts, and changing political landscapes, determining the right amount to save and withdraw has become increasingly complex.

What are the first steps of retirement planning?

While everyone’s situation is unique, some crucial initial steps include:

- Determining your retirement goals.

- Estimating your expenses.

- Assessing your current financial resources.

Two critical questions stand at the forefront of retirement planning:

- Determining the adequate savings threshold for a comfortable retirement.

- Establishing a sustainable annual withdrawal rate that preserves your financial security.

For those considering early retirement, these questions become even more critical, as a longer retirement horizon requires careful planning to ensure financial stability.

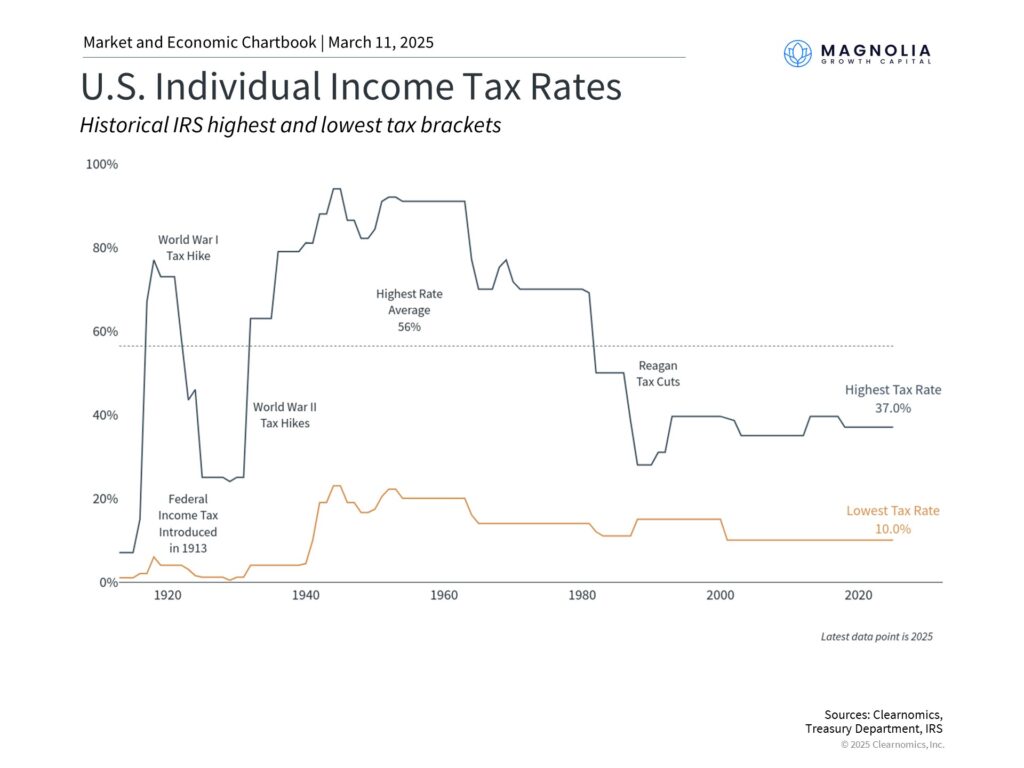

The Role of Taxes in Retirement Planning

US tax rates have fluctuated significantly throughout history. Effective tax management of retirement accounts should be viewed as a year-round strategic priority within your comprehensive financial plan, not just a tax season consideration. While retirement accounts offer significant tax advantages, maximizing these benefits is not the only consideration. Current income, expected income in the future, various life events, and aligning the timing of contributions versus other investments requires ongoing attention and planning over a lifetime.

Whether you are early in your career, approaching, or already in retirement, there are tax considerations to be aware of. Proactive tax planning helps optimize both retirement account contributions and withdrawals. For instance, should you maximize your 401(k) or contribute to an IRA instead? While IRA contributions can be made until the tax filing deadline, potentially reducing your previous year’s taxable income, 401(k) contributions must be completed by December 31st. Understanding these different deadlines and planning accordingly can help maximize tax advantages. If you are over 50, you also have additional opportunities through catch-up contributions.

Tax considerations become even more critical during retirement, particularly regarding Social Security and Required Minimum Distributions (RMDs). Rather than waiting until year-end, early planning for RMD obligations can help avoid costly penalties and create more efficient withdrawal strategies. Given recent regulatory changes to RMD rules, incorporating regular tax planning discussions with a trusted advisor has become increasingly important.

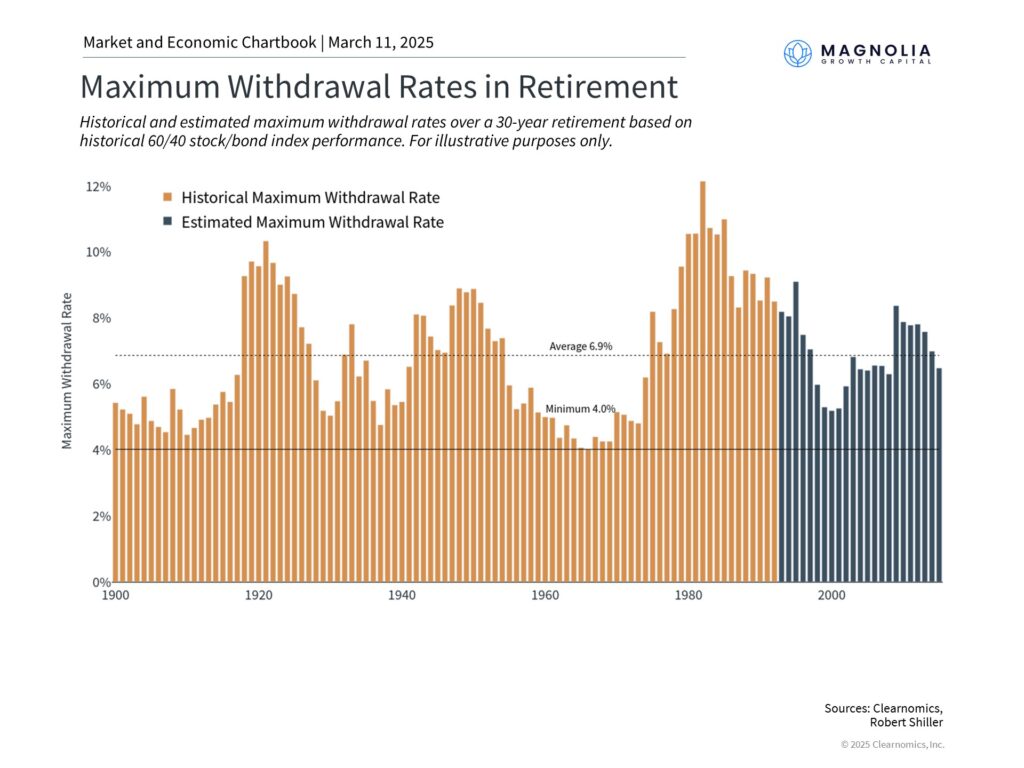

Historical Analysis and the 4% Rule

Historical analysis reveals varying sustainable withdrawal rates. The answers to these questions are uniquely individual and rely on several key variables: investment returns, evolving spending requirements, and retirement duration. These fundamental factors form the foundation of effective retirement planning, determining whether your savings will endure throughout your retirement journey.

Many start with common guidelines like the “4% rule.” This principle, established by William Bengen, suggests that historically, withdrawing 4% annually from a retirement portfolio, adjusted for inflation, has proven “safe” over a 30-year retirement horizon, minimizing the risk of depleting savings.

However, individual experiences vary based on personal circumstances, market conditions, and retirement duration. The historical maximum withdrawal rate has often exceeded the 4% rule, suggesting that a more nuanced approach to retirement withdrawals may be appropriate. Thus, the 4% rule serves as an initial framework rather than a definitive solution.

The Retirement Smile

Understanding retirement spending patterns is crucial. Research indicates a “retirement smile” spending trajectory – higher initial expenses during active early retirement years, followed by reduced spending in middle retirement, before potentially increasing due to healthcare costs in later years.

Careful consideration of this spending pattern, along with tax implications and investment strategies, is essential for optimizing retirement distributions and potentially maximizing the assets available for legacy planning

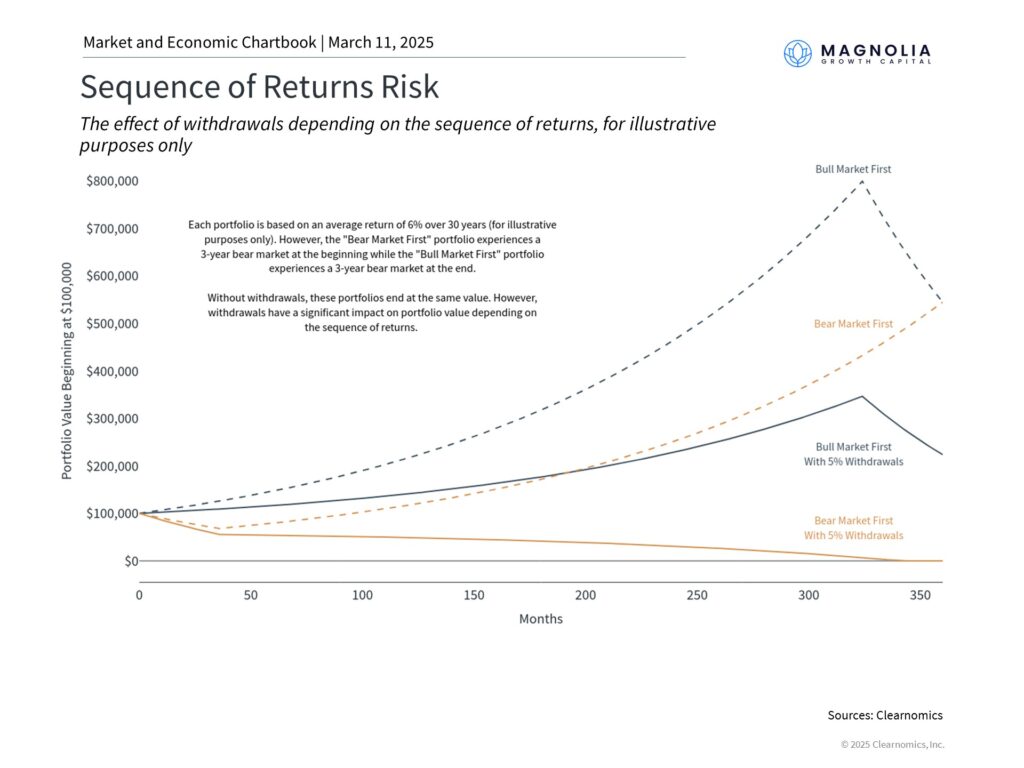

Market Timing and Sequence of Returns Risk

The ‘Sequence of Returns Risk’ illustrates how the timing of market fluctuations can significantly impact your retirement portfolio. As you can see, experiencing negative returns early in retirement can have a much larger impact on your portfolio’s longevity than negative returns later on. This highlights the importance of careful planning and potentially more conservative withdrawal strategies in the early years of retirement.

Year-to-year variations in safe withdrawal rates reflect market volatility across cycles. Market ups and downs affect portfolio value during retirement withdrawals and require particular attention, especially given current high market valuations and inflation levels.

The Need for a Personalized Approach

The 4% rule’s simplistic assumptions may not adequately address individual portfolio differences, risk tolerance, taxes, or fees. Its underlying 60/40 stock/bond allocation might prove too aggressive for many retirees, particularly in later years. Effective retirement planning requires a more comprehensive, personalized approach incorporating specific investment strategies, risk preferences, spending patterns, and tax considerations.

Success in retirement withdrawal strategies depends on maintaining an appropriate investment approach throughout retirement. Emotional reactions to market declines can prevent participation in subsequent recoveries, potentially compromising long-term withdrawal sustainability. Professional guidance often proves valuable in navigating these challenges over decades-long retirements.

Legacy Planning through Trusts

For those with excess savings, legacy planning becomes an important consideration. Trusts can be a powerful tool for transferring wealth to future generations while potentially minimizing tax liabilities. A well-structured trust can provide control over assets, protect beneficiaries, and offer flexibility in distribution.

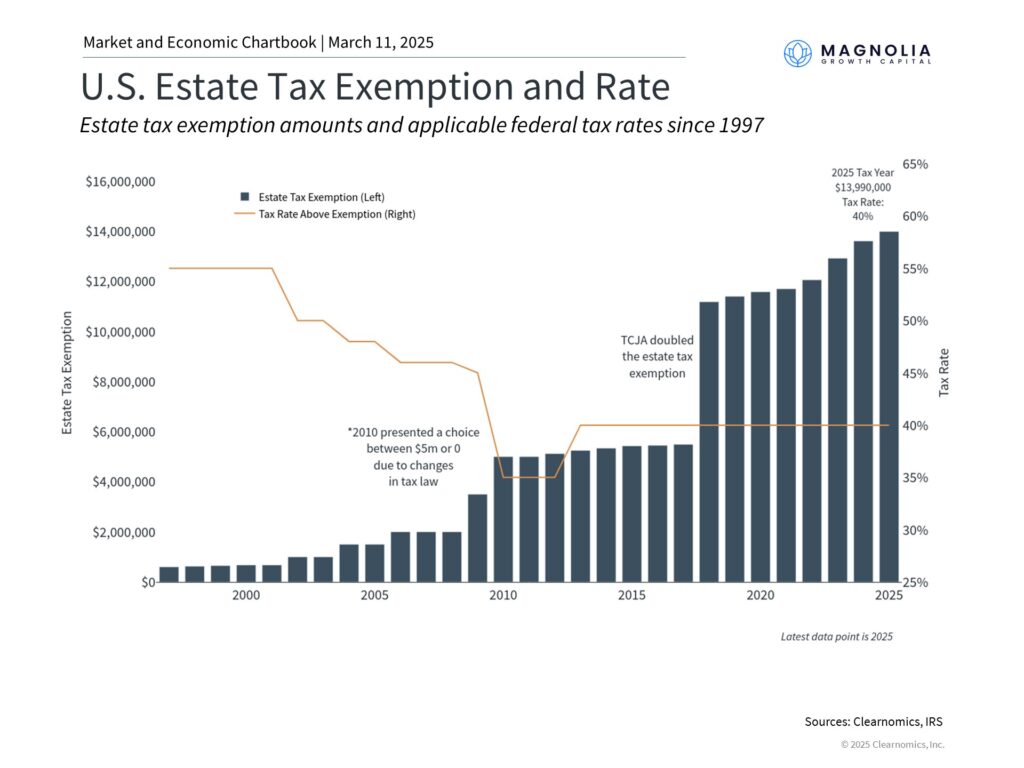

Integrating Legacy Planning with Retirement Withdrawals

When integrating legacy planning with retirement withdrawals, it’s crucial to consider the estate tax landscape. Estate tax exemptions and rates have fluctuated over time. For example, if your estate exceeds the current exemption, you may want to consider withdrawing more during your lifetime to reduce the taxable estate and potentially lower the estate tax burden on your heirs.

Additionally, various trust strategies can be used to maximize the use of the estate tax exemption and minimize estate taxes. A qualified estate planning attorney or financial advisor can help you navigate these complexities and develop a strategy that aligns with your legacy goals and minimizes potential tax liabilities.

Conclusion

While the 4% rule provides a useful starting point, effective retirement planning requires personalized analysis of your specific circumstances, goals, and needs. By carefully considering your retirement needs, legacy goals, and the available financial tools, you can create a comprehensive plan that ensures a comfortable retirement while potentially leaving a lasting legacy for your loved ones. Professional guidance can help develop a comprehensive strategy for a secure retirement journey.