Israel-Iran Conflict: How Wars Impact Investors

The conflict between Israel and Iran has captured global attention and created uncertainty in financial markets. While the humanitarian consequences are the most important consideration, it’s also necessary for investors to understand how such events impact markets. Despite short-term volatility, history suggests that even serious conflicts tend to have limited long-term impact on global financial markets, with markets typically recovering within weeks or months. Maintaining perspective and focusing on long-term financial goals remains the best approach.

The Middle East Conflict: Navigating Market Volatility

The escalating conflict between Israel and Iran has once again seized global attention, injecting significant uncertainty into financial markets. Recent days have seen a direct exchange of attacks, intensifying the situation. This complex geopolitical landscape naturally raises questions for investors.

Current Dynamics of the Israel-Iran Conflict

Israeli strikes on Iranian nuclear facilities and military targets commenced on June 13. In the subsequent days, Israeli forces have reportedly targeted Iranian missile and drone facilities, as well as military leadership, with some reports indicating damage to uranium conversion facilities.

In retaliation, Iran has launched its own missile and drone attacks, with some reaching Israeli territory and causing damage, including to an Israeli military intelligence facility. The conflict has also reportedly damaged critical infrastructure on both sides, including natural gas facilities and oil refineries. While the situation remains fluid and can change rapidly, there are emerging reports that Iran might be open to ending hostilities and resuming talks regarding its nuclear programs. This is unfolding even as the Israel-Gaza war continues and other regional conflicts persist globally.

Investor Concerns: Will Conflicts Escalate?

While the humanitarian consequences of these conflicts are paramount, investors must also understand their impact on markets. A major concern among investors is the potential for these events to escalate into full-scale global wars. While this possibility always exists, recent history suggests otherwise.

Even severe conflicts, such as Russia’s invasion of Ukraine and Hamas’s attack on Israel, have largely remained contained, resulting primarily in short-term stock market volatility. This isn’t to downplay the severity of these conflicts, but rather to highlight that overreacting with investment portfolios can be counterproductive. In such times, maintaining perspective and focusing on historical lessons and long-term market trends is crucial.

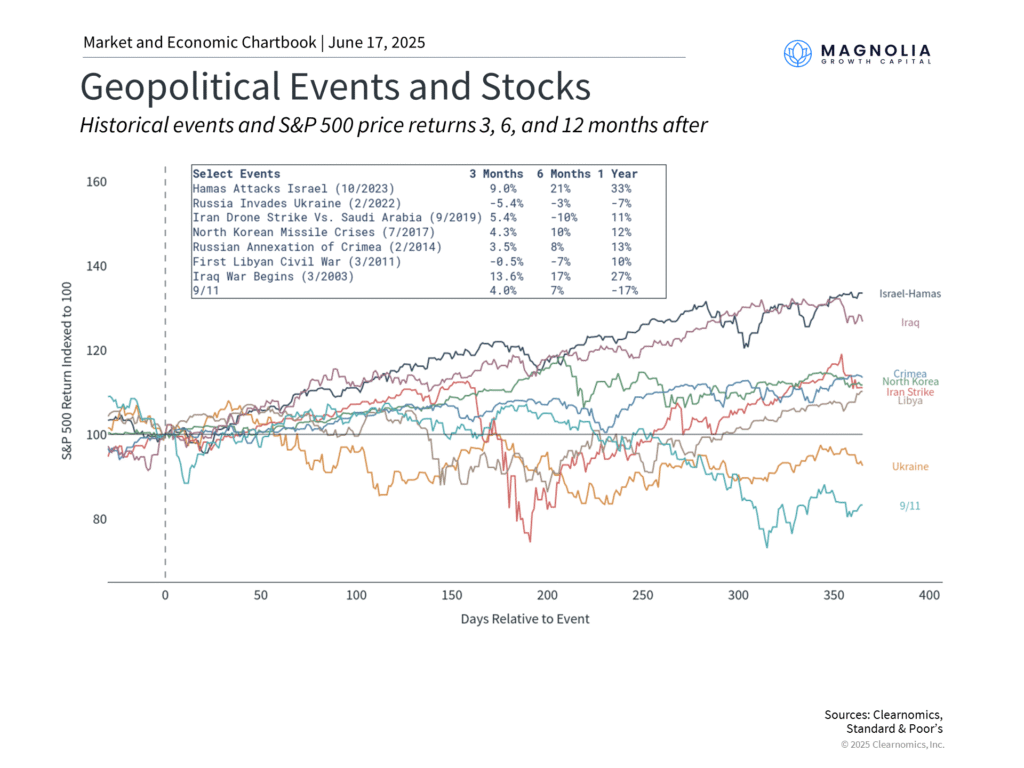

Historical Market Reactions to Geopolitical Events

Historians often view each event as unique, with distinct narratives, causes, and consequences. Economists, conversely, seek patterns and similarities across events to draw broader conclusions. For investors, both perspectives are vital to discern which lessons apply and which do not. As the saying goes, “history doesn’t repeat itself, but it often rhymes”.

Looking back over the past 25 years, geopolitical events, including Middle East conflicts that influenced oil prices like the Iranian drone strikes on Saudi Arabia in 2019, demonstrate a common pattern. While short-term market swings are common, markets have typically recovered from geopolitical shocks, often within weeks or months. The more significant factor during these periods has consistently been underlying business cycle trends.

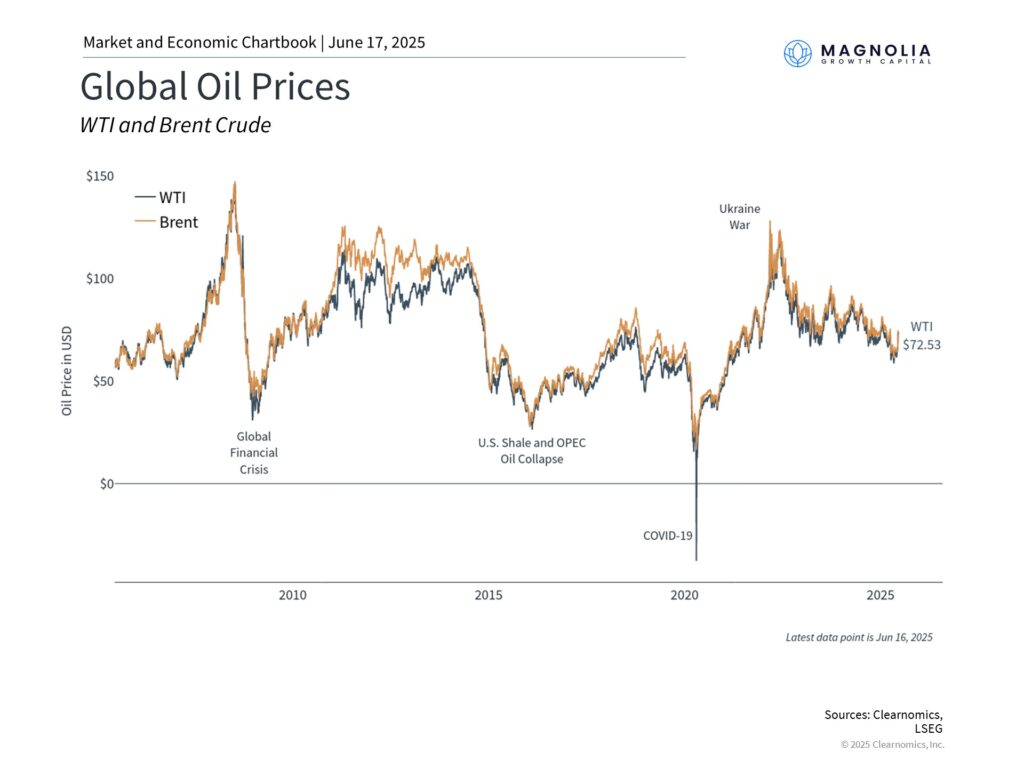

Global Oil Prices: A Key Transmission Mechanism

In the immediate term, oil prices often serve as a direct conduit through which regional conflicts affect the global economy. The latest conflict’s initial market reaction centered on energy markets, with Brent crude futures rising above $74 per barrel. While still volatile, oil prices have since fallen back towards $70 per barrel amidst signs of possible de-escalation.

Oil prices are a critical input for nearly all products and services, making their volatility impactful on the global economy. Higher oil prices translate to more expensive gasoline and increased transportation costs, subsequently raising prices for consumers and businesses. The potential closure of vital shipping lanes, such as the Strait of Hormuz in the Persian Gulf, which carries approximately one-third of the world’s oil supply, further compounds this concern.

However, it’s essential to maintain perspective on current oil price levels. Despite recent fluctuations, prices remain well below the peaks of over $120 per barrel seen in 2022 during the early stages of the Russia-Ukraine conflict. The current price of around $70 per barrel falls within the range experienced over the past few years, with fluctuations between $60 and $82 per barrel occurring just this year.

Furthermore, the U.S. has significantly increased its energy independence over the last two decades. American oil production now exceeds 13.5 million barrels per day , and surprisingly, the U.S. is the world’s largest producer of both oil and natural gas. While the U.S. still relies on foreign oil and is susceptible to global price movements, this substantial domestic supply helps to insulate its economy and financial markets.

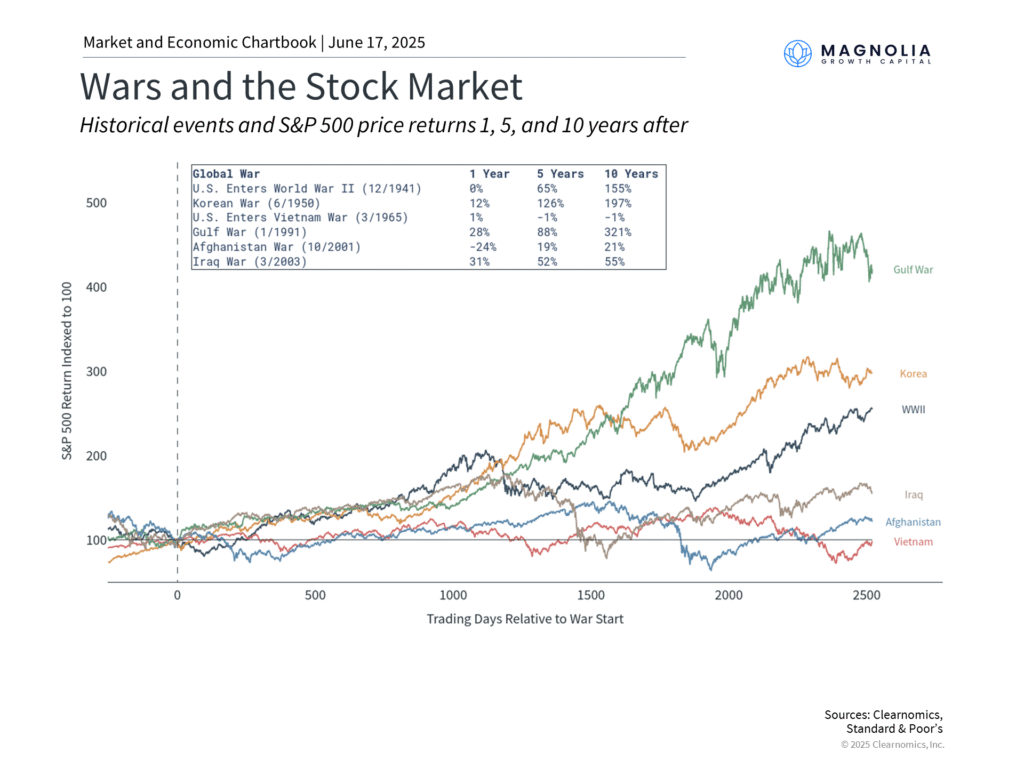

Long-Term Market Impact of Wars

For investors concerned about escalating global conflicts, a broader historical view can offer valuable perspective. From World War II to the Iraq War, markets have shown short-term reactions to conflicts, but their long-term performance has consistently been driven by investment fundamentals.

For example, World War II jump-started industrial production after the Great Depression, and led to a significant shift in the labor market with women entering the workforce. These factors helped propel the economy through the rest of the century. Similarly, the Gulf War affected oil prices, but also coincided with the Information Technology revolution of the 1990s. In contrast, the decade following the Vietnam War coincided with high oil prices and stagflation, resulting in poor market performance.

Again, none of this is to trivialize the humanitarian and societal consequences of these wars. For the current situation, much will depend on whether the conflict expands further or begins to de-escalate. The involvement of major powers and threats to critical supply routes add complexity, but history suggests that even significant regional conflicts tend to have limited long-term impact on global financial markets.

The bottom line? While Middle East tensions have created short-term market volatility, investors should maintain perspective and avoid overreacting to headlines. A portfolio aligned with long-term financial goals remains the best approach for navigating periods of geopolitical uncertainty.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Magnolia Growth Capital LLC (referred to as “MGC”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute MGC’s judgement as of the date of this communication and are subject to change without notice. MGC does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall MGC be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if MGC or a MGC authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.