Are We Heading for Recession? All-Weather Strategies for Tariff-Driven Uncertainty

Are tariffs leading us to a recession? Discover all-weather investment strategies to protect your portfolio. Learn how to balance offense and defense, identify opportunities, and navigate market uncertainty.

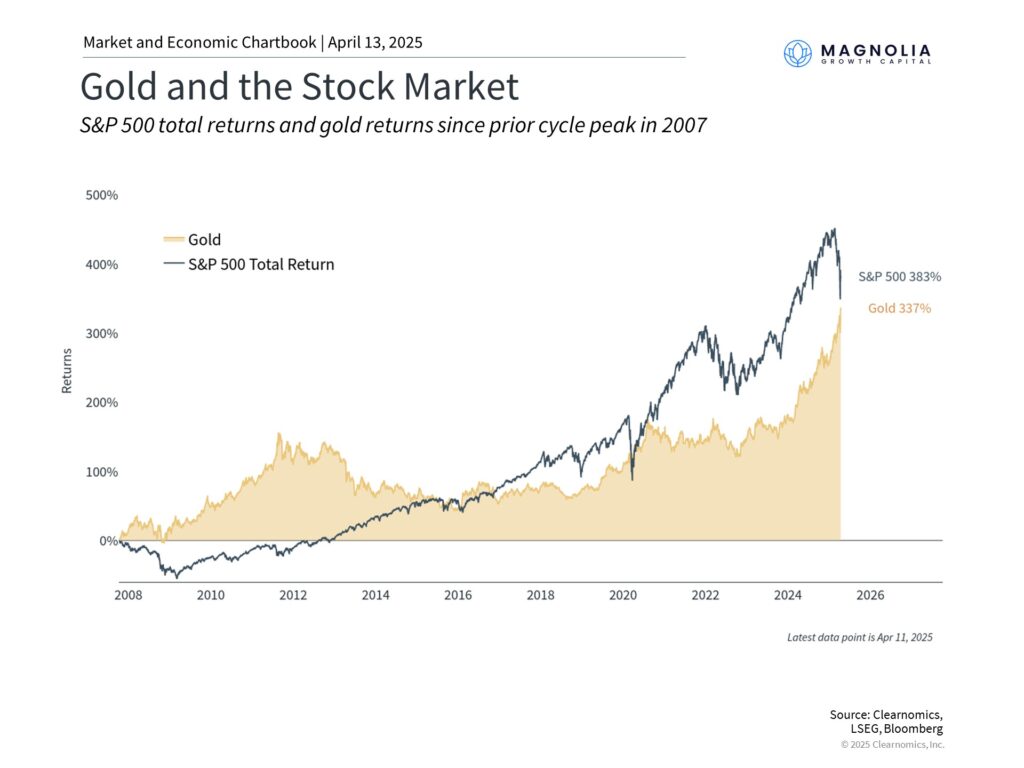

Concerns that a trade war will lead to a recession have spread around the globe. The possibility of retaliatory tariffs is on investors’ minds, with China responding with counter-tariffs, increasing the odds of a worst-case trade war scenario. Markets in Asia and Europe have declined alongside U.S. stocks, and while there has typically been a “flight to safety” into bonds, the uncertainty surrounding tariffs and policy in Washington is eroding the traditional safe-haven status of Treasuries. Amidst this widespread volatility and the diminishing appeal of conventional safe havens, gold stands out as the sole asset that has effectively weathered the recent market turbulence. Its price appreciation reflects a clear investor preference for its stability and historical role as a store of value during periods of economic and geopolitical uncertainty.

Why Diversification and Investment Planning are Important?

In the world of investing, just like in sports, success hinges on a well-coordinated approach that incorporates both offense and defense.

- Defense: This involves constructing a portfolio designed to withstand the inevitable shocks of the market cycle. Market downturns and unforeseen events are unavoidable, making defensive positioning a cornerstone of long-term financial security. Defensive strategies prioritize capital preservation and aim to mitigate losses during periods of market stress.

- Offense: Conversely, offense entails strategically capitalizing on opportunities that arise from market fluctuations. Ironically, periods of market turmoil, while unsettling, often present the most compelling entry points as asset prices become more attractive. This is where investors can potentially generate outsized returns.

The key is that a portfolio aligned with long-term financial goals requires both offensive and defensive components. The challenge lies in effectively positioning within the current market to both manage risk and seize emerging opportunities.

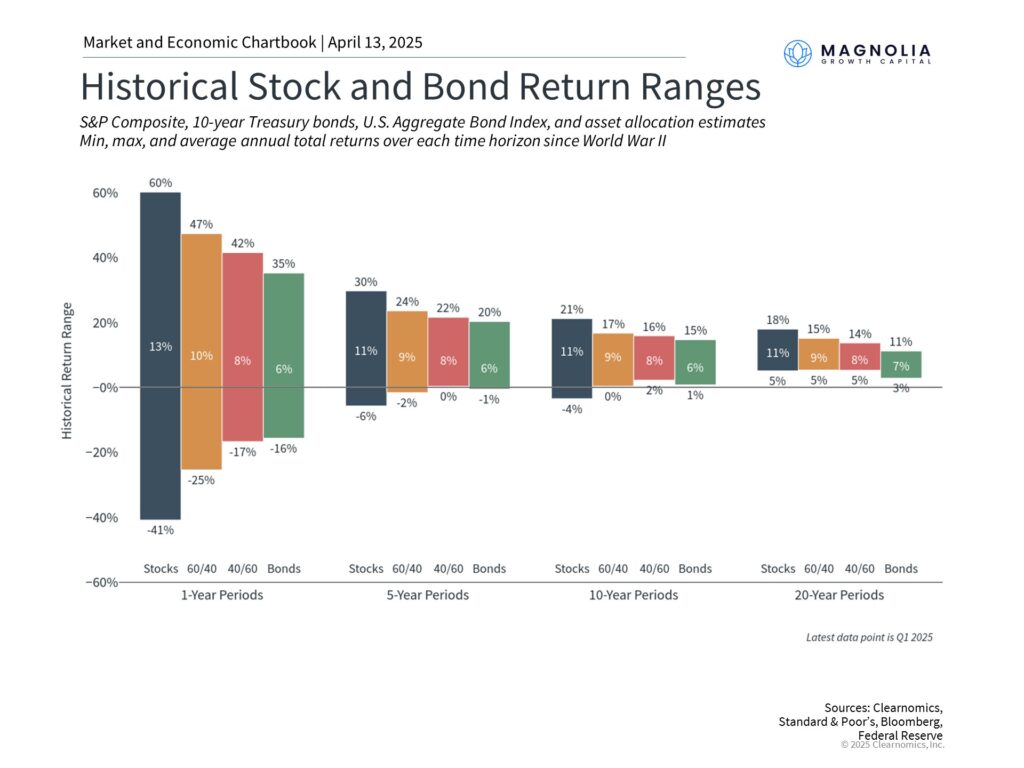

Two of the key principles of long-term investing are diversification and maintaining a long time horizon. Our chart above clearly depicts the impact of these principles by showcasing the range of historical returns for stocks, bonds, and diversified portfolios across different timeframes. For instance, it’s easy to see that over just one-year periods, the stock market can vary significantly, from gaining 60% in 1983 when the market recovered from stagflation fears, to -41% during the global financial crisis.

Moving beyond just one-year periods and a stock-only portfolio underscores why these are powerful ways to think about investing and financial planning. Diversifying might reduce the maximum returns an investor can experience, but it also reduces risk. This is evident in the balanced portfolio consisting of 60% stocks and 40% bonds. So far this year, the S&P 500 is 13% lower, but a 60/40 mix of these indices has declined only 4.6%.

After all, the goal is not simply to grow a portfolio at the fastest but most volatile rate, but to have the highest possible probability of achieving your financial goals. A diversified portfolio historically has a much narrower range of outcomes, allowing investors to better plan toward their goals.

Similarly, extending your time horizon by even a few years can have a significant impact on the range of outcomes. History shows that, since World War II, there has not been a 20-year period in which any of these assets and portfolios have experienced annual declines, on average. The same is true over 10-year periods for many diversified asset allocations. While this is only illustrative and is no guarantee of future performance, it clearly shows the importance of thinking long-term.

Volatility as a Catalyst for Opportunity

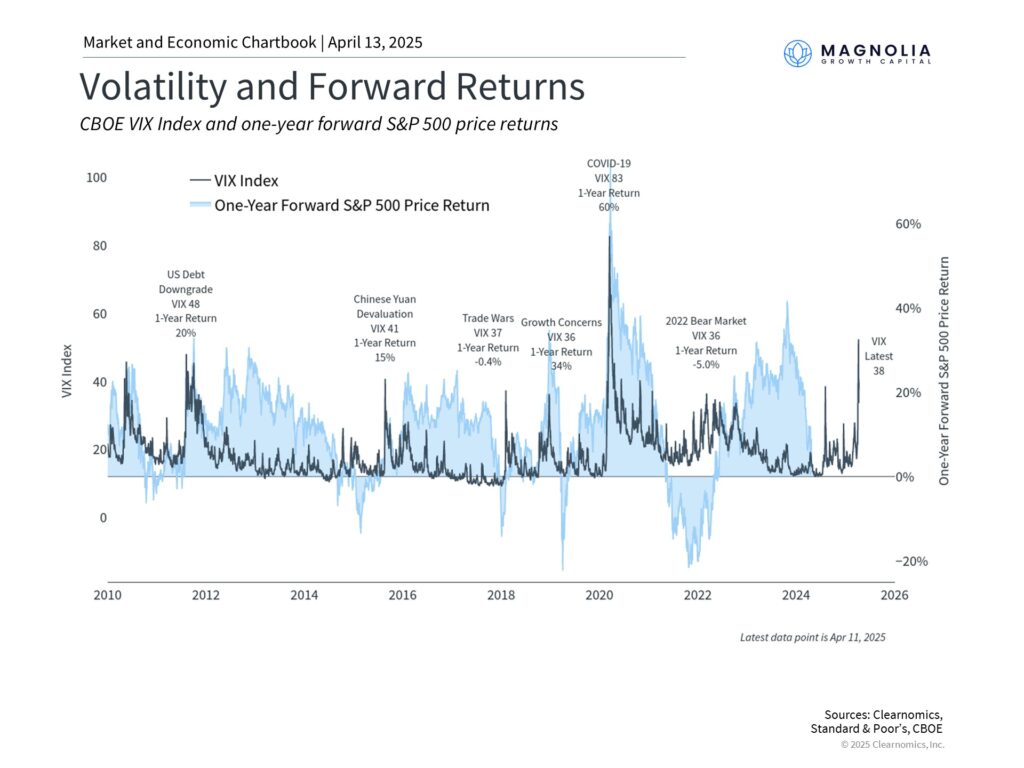

What about market opportunities? The accompanying chart shows that the VIX index, often known as the stock market’s “fear gauge,” can spike on a periodic basis. These peaks correspond to sharp drops in the market, such as in 2008 or 2020. These are times when markets are the most nervous and, in many cases, investors feel as if the situation will never stabilize.

This chart also shows the returns of the S&P 500 over the next year. As we discussed above, there is never any certainty about returns over any single year for the stock market. However, it’s clear that the greatest market opportunities often emerge when investors are the most worried. This is the heart of the famous Warren Buffett quote to “be fearful when others are greedy, and greedy when others are fearful.”

This is especially true if markets face liquidity rather than solvency concerns. Liquidity problems emerge when market declines force some investors – specifically those who use leverage, or borrowed funds – to sell other assets. In these situations, prices may decline even when the underlying fundamentals of an asset remain unchanged. These are classic cases where short-term market moves become disconnected from long-term outlooks, creating opportunities for patient investors.

It’s important to note that this is not an argument for market timing. Even when the VIX is high, there is no guarantee that markets will rebound quickly. Instead, investors should view this as additional support for taking a portfolio perspective. Market downturns often occur when valuations are the most attractive, and thus it can make sense to shift toward – not away – from these assets. Of course, what makes sense for a given portfolio depends on the specific circumstances.

Asset Allocation in the Current Environment

Given the current market dynamics, characterized by trade tensions and economic uncertainty, strategic asset allocation is paramount.

- Defensive Play – Gold and Short-Term Bonds: Gold has re-emerged as a compelling asset in the face of market uncertainty. Its impressive year-to-date performance (21.4%) highlights its enduring appeal as a store of value and a hedge against volatility. Short-term bonds have proven valuable this year, providing stability and offsetting losses in riskier asset classes. Their lower volatility and tendency to move inversely to stocks make them a classic defensive component.

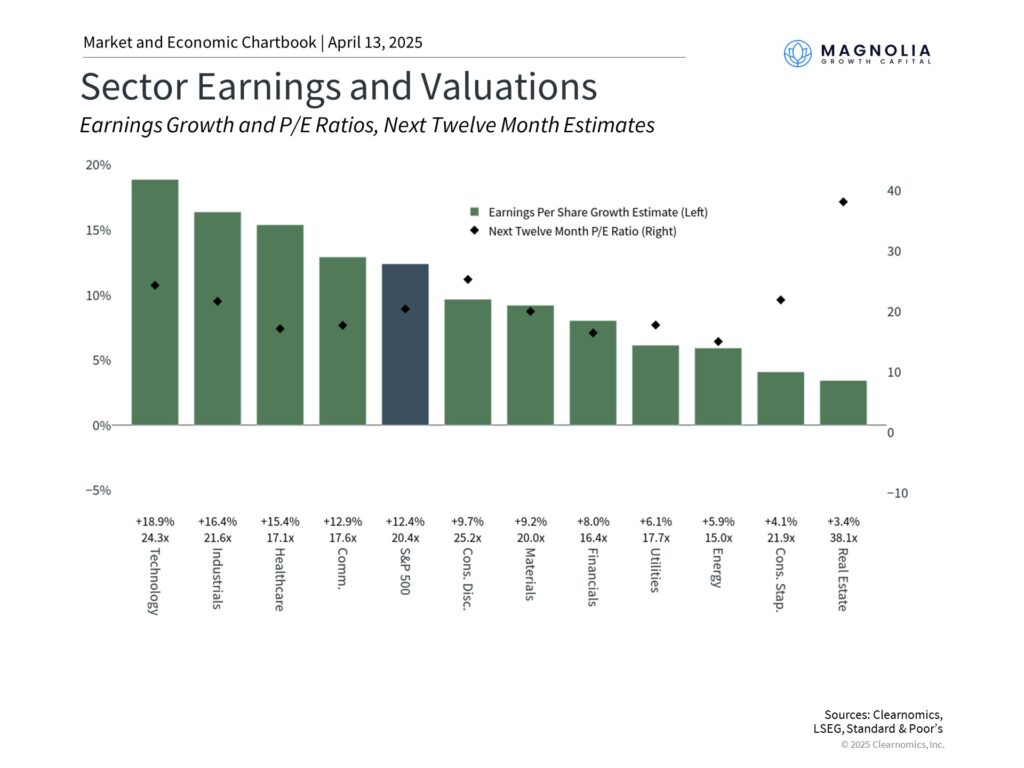

- Offensive Play: Selective Equity Opportunities: While overall market valuations have become more attractive (as shown in Chart 3), opportunities for offensive positioning lie in selective sectors. Sectors like Information Technology, Communication Services, and Consumer Discretionary have experienced significant valuation declines, presenting potential for long-term growth as conditions stabilize. A disciplined approach to fundamental analysis is crucial to identify companies with strong long-term prospects within these sectors.

Investors are typically drawn to gold as a potential store of value during times of uncertainty, similar to the appeal of bonds. This continued upward trend in gold prices stands in contrast to Bitcoin, which, despite its limited supply and “digital gold” narrative, has exhibited significant volatility this year and, according to some data, even negative year-to-date performance. This divergence highlights that while both are considered scarce assets, gold’s established history and recent performance more consistently reflect its role as a safe haven during market uncertainty, underscoring its importance in a well-diversified portfolio strategy.

Bottom line? Navigating today’s complex market landscape demands a dynamic strategy that effectively blends offensive and defensive maneuvers. By embracing diversification, maintaining a long-term perspective, and strategically allocating assets, investors can both mitigate risk and capitalize on opportunities.

We strongly encourage you to schedule a personalized portfolio review with us. We can help you assess your current positioning, align your strategy with your financial goals, and identify specific opportunities and risks relevant to your individual circumstances.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Magnolia Growth Capital LLC (referred to as “MGC”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute MGC’s judgement as of the date of this communication and are subject to change without notice. MGC does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall MGC be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if MGC or a MGC authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.