What U.S.-China Trade Negotiation Progress Means for Investors

This special update discusses the positive market reaction to the new U.S.-China trade agreement, which scales back tariffs. We analyze the agreement’s details, its potential for a broader trade resolution, and what it means for investors.

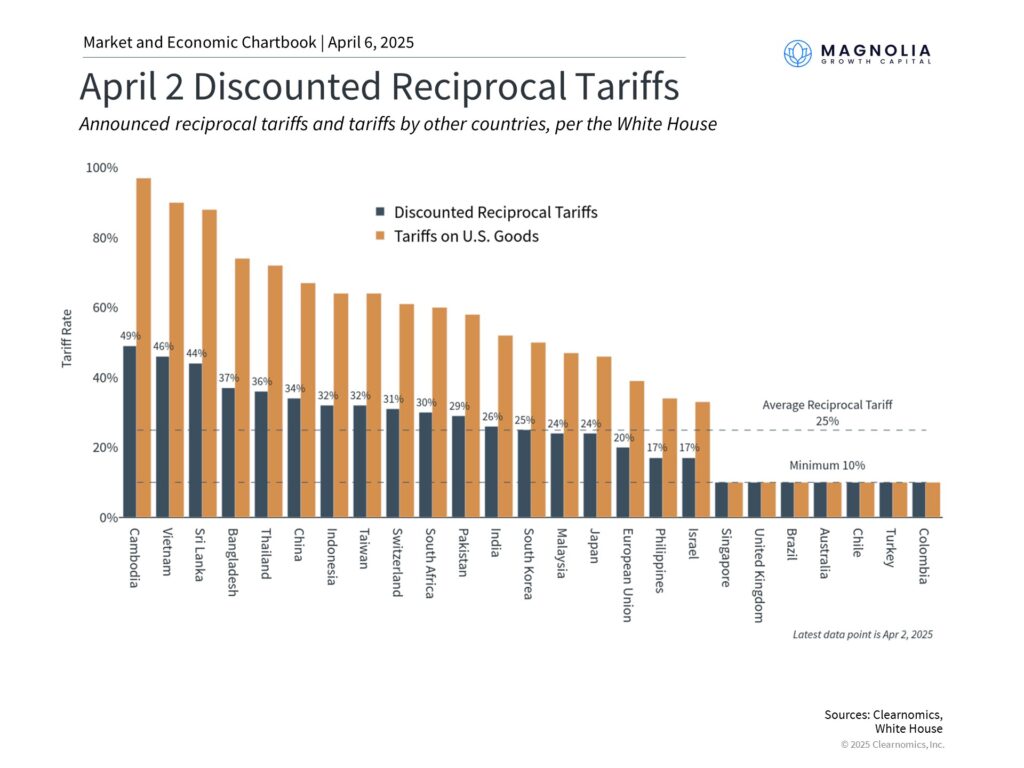

The recent trade announcement between the U.S. and China reverses many of the tariffs that rattled financial markets beginning in April. This agreement, which lasts 90 days, lowers U.S. tariff rates on China from 145% to 30%, and China’s rates on U.S. goods to 10%. Along with tariff pauses on other trading partners, and a newly announced trade deal with the U.K., markets are hopeful that a drawn-out trade war is now off the table. What does this changing market narrative mean for long-term investors?

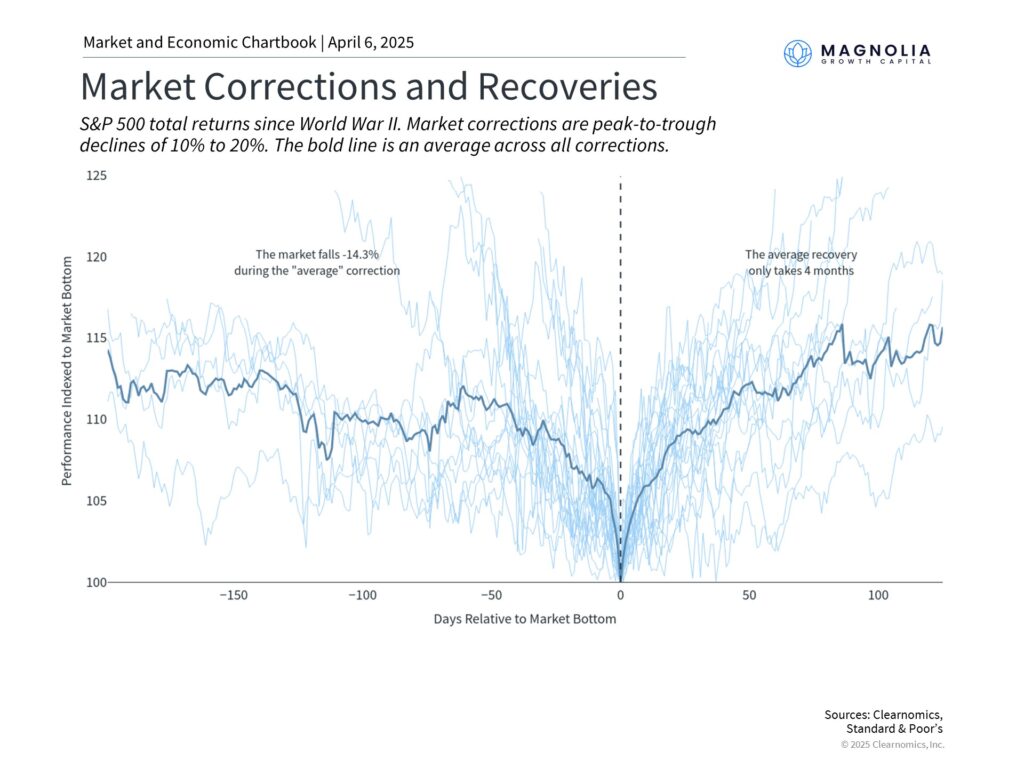

What markets dislike most are uncertainty and negative surprises. This is because markets often react to the worst-case scenarios immediately and adjust as more information becomes available. While the unexpected size and scope of the April 2 tariffs sparked a sharp market downturn, the recovery over the past several weeks has also been swift.

Markets are close to where they started the year and slightly above their pre-April 2 tariff announcement levels. This is a pattern that follows many other historical examples in which recoveries can occur once there is greater clarity. Recent events are another reminder that maintaining a long-term investment perspective is important during periods of uncertainty.

The U.S.-China agreement is a positive sign a broader deal can be reached

The latest tariff agreement between the U.S. and China is positive because it removes a significant source of market uncertainty. It sets the U.S. reciprocal tariff on Chinese goods to 10% while maintaining the 20% tariff related to the fentanyl crisis put in place earlier this year. While the situation is still evolving, this agreement paves the way for a longer-term trade deal between the world’s two largest economies and de-escalates tensions. So, while tariff rates are higher than in the past, the worst-case scenario is now less likely.

With the benefit of hindsight, recent events mirror the trade tensions in 2018 and 2019 during the first Trump administration. In both cases, the administration’s goal has been to achieve new trade deals by using tariffs as a negotiating tool, with the stated aim of closing the U.S. trade deficit with major trading partners. Five years ago, this resulted in the “Phase One” trade agreement with China, the USMCA (United States-Mexico-Canada Agreement), and other deals.

There are many intertwined objectives in these trade policies, including a focus on manufacturing jobs, protecting intellectual property, controlling immigration, and more. Today, the key difference is that the administration has gone much further with tariff threats than many investors and economists had anticipated. Still, the recently announced trade deal between the U.S. and the U.K. is evidence that previous patterns may apply here as well. That agreement sets a baseline 10% tariff rate on U.K. goods, with specific provisions allowing up to 100,000 imported cars at this level as well as exemptions for steel and aluminum.

The economy has been resilient despite trade uncertainty

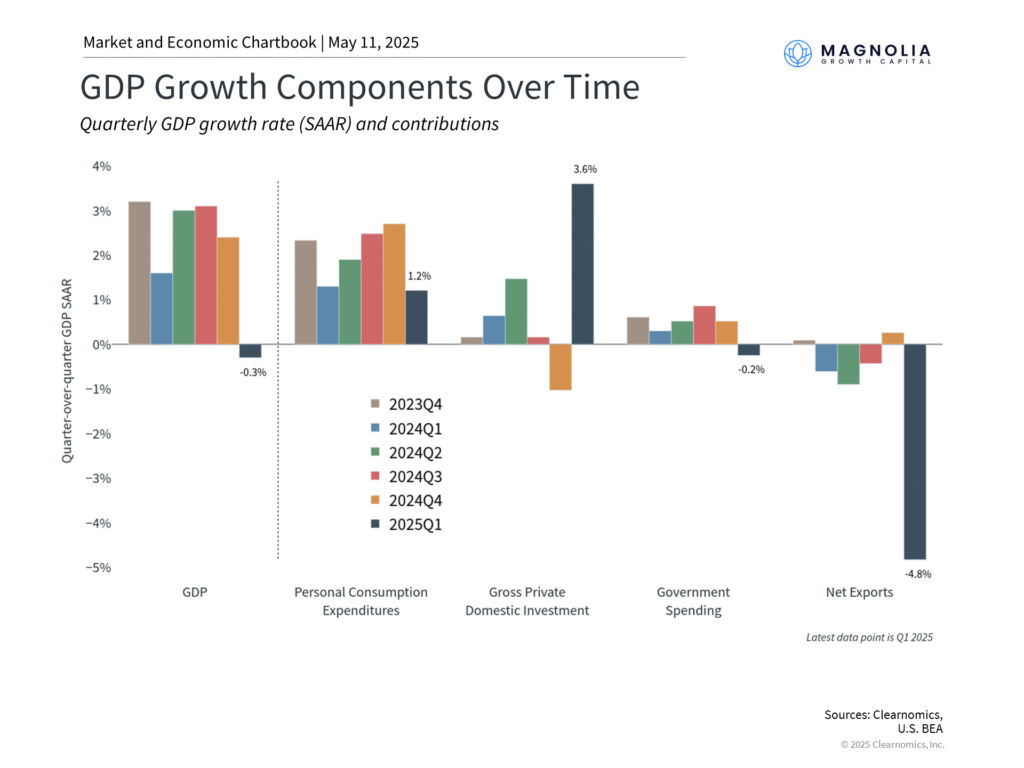

Of course, new trade deals with China and many other countries are not yet final, and day-to-day headlines could continue to drive market swings, especially if previous tariff pauses expire. An important reason markets have focused so heavily on tariffs is the impact on inflation and economic growth. This was reflected in the first quarter’s GDP figure which showed a slight economic contraction as businesses stockpiled imported goods ahead of tariff deadlines. Greater clarity will likely help both consumers and businesses.

In this environment, what else could go right? First, many economic indicators remain solid. The latest jobs report showed the economy added 177,000 positions in April, above expectations of 138,000. The unemployment rate held steady at 4.2%, continuing a period of stability that began last May. The strong job market helps to offset concerns that tariffs and uncertainty will impact consumer spending.

Meanwhile, inflation continues its gradual deceleration toward the Fed’s 2% target, with the latest Consumer Price Index figure coming in at 2.4% year-over-year. This deceleration has been supported by falling oil prices which recently reached four-year lows. Cheaper oil, driven in part by tariff-related volatility, helps to lower costs for consumers and can be a boost to the economy, all things equal.

The recent U.S.-China agreement also reduces the pressure for immediate Fed policy changes. Market-based measures still expect the Fed to cut rates further this year, but these expectations have fallen to only two or three cuts, possibly beginning in July or September. The Fed, which recently kept rates steady between 4.25% and 4.5%, appears to be taking a “wait-and-see” approach, rather than reacting to near-term trade, market, and economic news.

Market recoveries often occur when they’re least expected

While there are still many risks to the market, the last several weeks show how quickly the narrative can change. By their very nature, markets anticipate worst-case scenarios. During times of negative headlines and market pullbacks, it’s difficult to imagine that the market will ever recover. So, while understanding risks is always prudent, it should not come at the expense of long-term portfolio positioning.

The accompanying chart shows how market corrections have behaved since World War II. While the average correction experiences a decline of 14%, it often recovers in as little as four months. Most importantly, it can often rebound when it’s least expected, as we’ve experienced following recent progress on trade negotiations. Those investors who overreact to early signs of volatility may find that they are not appropriately positioned, especially with respect to their financial goals.

The bottom line? The latest U.S.-China trade announcement has lowered market uncertainty and recession concerns. For long-term investors, this reinforces the value of maintaining perspective during periods of market turbulence rather than reacting to short-term volatility.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Magnolia Growth Capital LLC (referred to as “MGC”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute MGC’s judgement as of the date of this communication and are subject to change without notice. MGC does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall MGC be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if MGC or a MGC authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.