Consumer Debt and the US Economy: Why Consumer Health Matters

Consumer spending drives a significant portion of the U.S. economy. Understanding the financial health of consumers is essential, especially in times of uncertainty. This blog examines the apparent contradictions in consumer debt data and what they mean for investors navigating a “two-speed economy.”

Consumer Debt in a Two-Speed Economy

The financial health of consumers is an important indicator of the broader economy. Consumer spending represents about 70% of all spending across the economy, and steady purchases are one reason economic growth has exceeded expectations over the past few years. However, recent consumer weakness is a concern among investors worried about a possible recession.

Recent headlines paint a picture of rising debt levels and late payments amid worries of inflation and slowing growth. At the same time, other economic data shows strong consumer balance sheets, record-high household net worth, and manageable monthly payments. This apparent contradiction has left many investors wondering which narrative to believe, and whether cracks are forming beneath the surface.

The answer lies in understanding what economists sometimes call a “two-speed economy,” where financial situations vary across consumer segments based on income, wealth levels, credit scores, and more.

While the financial challenges to large parts of the country should not be taken lightly, it’s important to separate what affects individuals and households from what impacts the stock market and portfolios. Consumer health indicators should be viewed as part of a more comprehensive picture that includes savings rates, debt service ratios, and overall net worth. This broader view helps explain why financial markets have remained relatively resilient despite these challenges.

Consumer Late Payments Are On The Rise

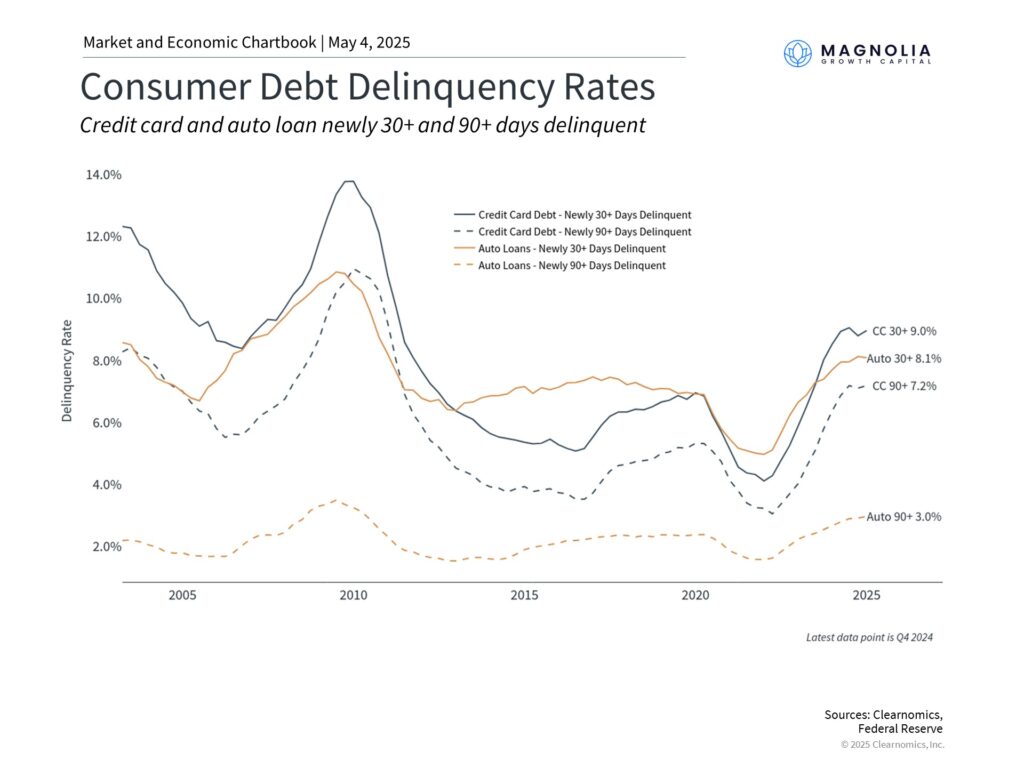

One of the most closely watched indicators of consumer stress is the delinquency rate on various types of loans. Delinquencies occur when a consumer is late on their debt payments, which can occur for many reasons. Over the past two years, credit card and auto loan delinquencies have increased significantly, as shown in the accompanying chart.

Delinquencies are typically tracked in stages based on the number of days a payment is past due. A loan enters early-stage delinquency when payment is 30 days late, with severity increasing at 60 and 90+ days. The transition to new delinquencies is particularly important since it captures consumers who have recently begun struggling with payments. The fact that 90+ delinquencies for credit card loans have increased suggests that some consumers face ongoing financial difficulties.

Auto loan delinquencies are particularly telling because consumers tend to prioritize the repayment of these debts, even during periods of financial difficulty. This is because having a car is essential for commuting to work and maintaining daily activities. This was especially true during the housing bubble when many mortgages were “underwater” – i.e., homeowners owed more on their mortgages than their homes were worth.

Delinquencies Vary Significantly by Credit Quality

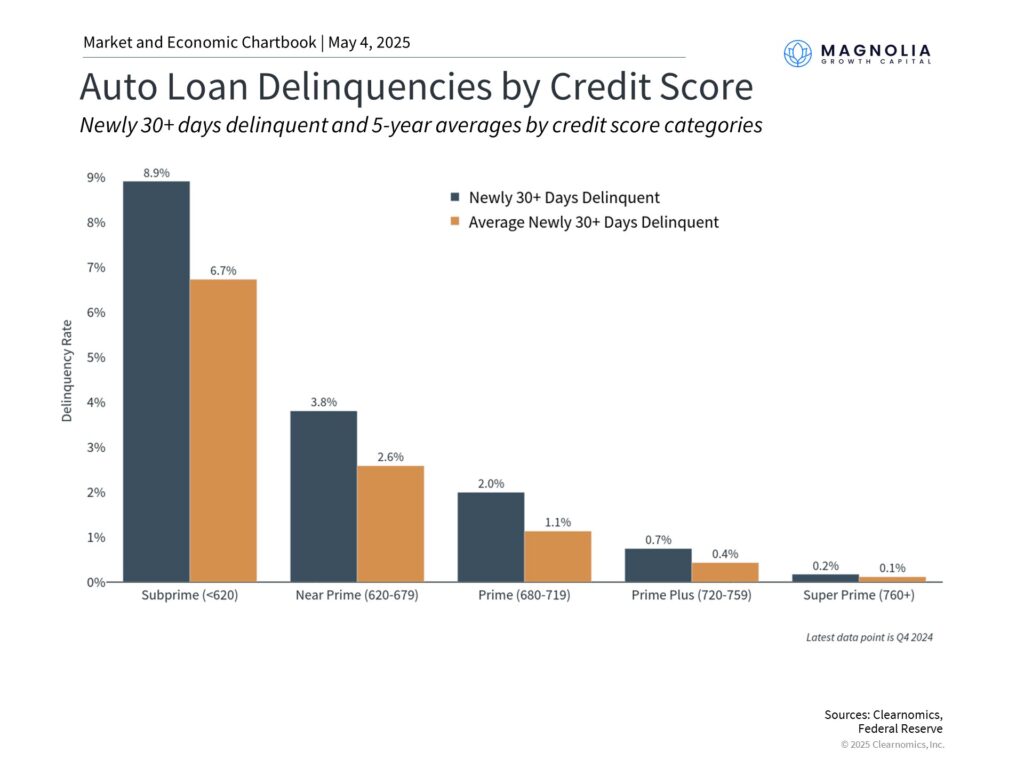

What explains rising delinquencies and the divergence among types of loans? Recent data shows that these factors are driven primarily by varying credit quality. Credit quality is typically categorized along a spectrum, from subprime (borrowers with weaker credit histories) to prime (those with stronger credit profiles). Prime borrowers generally present lower default risk to lenders, while subprime loans often command higher interest rates due to a lower likelihood of being repaid in full.

Recent figures suggest that the overall rise in auto loan delinquencies is concentrated heavily among borrowers with lower credit scores. As the accompanying chart shows, the difference in delinquency rates between subprime and prime borrowers is significant both in absolute terms and relative to their historical averages. Other data suggest the same pattern can be found in credit card delinquency rates.

This pattern also explains why major banks have not signaled broader concerns about the financial health of consumers. During recent earnings calls, bank executives noted the continued resilience of their consumer portfolios. This is true despite tariff fears, poor consumer confidence, heightened inflation concerns, and other worries.

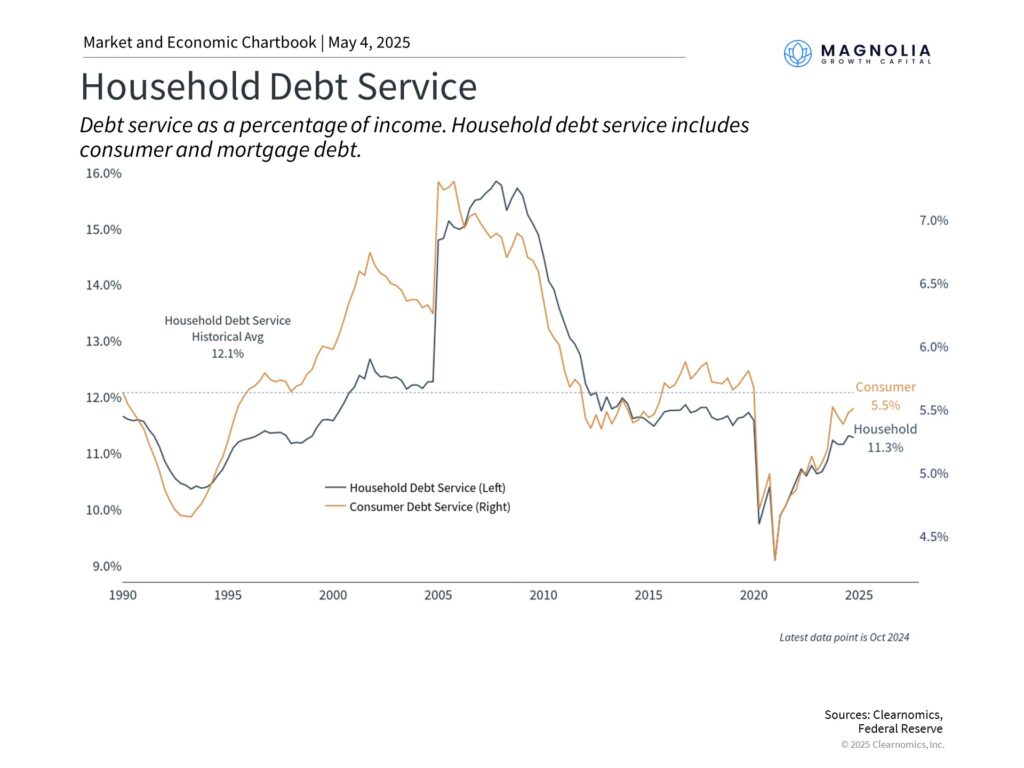

Overall Debt Service Levels Remain Manageable

The reality is that debt levels tend to rise over time as the economy grows. To properly assess consumer financial health, it’s important to consider debt levels in relation to income and savings. For instance, the ratio of consumer debt payments to household income currently stands at 5.5%. While this figure is moving toward its long-term average, it remains low by historical standards. This suggests that the average consumer is still in a healthy position when it comes to managing their monthly payments.

Similarly, household savings rates have stabilized in recent months, with Americans now saving approximately 4.6% of their paychecks, although this remains below the historical average of 6.2%. Also, U.S. household net worth remains near record levels despite the market and economic uncertainty of the past few years. Together, these factors provide a strong foundation for the financial health of many consumers.

It’s important to acknowledge that these aggregate statistics can mask significant variation across demographic and economic groups. The challenges faced by subprime borrowers in this “two-speed economy” are a real and concerning development. However, from a macroeconomic and market perspective, the broader indicators of consumer finances remain healthy.

What does this mean for investors? While tariffs and market volatility have led to heightened inflation and recession concerns, overall consumer trends are still strong. This is positive for investors with portfolios that can withstand short-term market swings as markets stabilize from economic and policy uncertainty.

The bottom line? The two-speed economy explains why the overall consumer picture looks resilient despite pockets of financial stress. For investors, it’s important to focus on the longer-term trends to stay invested and achieve financial goals.

This communication is for informational purposes only and is not intended as tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon as the sole factor in an investment making decision.

Past performance is no indication of future results. Investment in securities involves significant risk and has the potential for partial or complete loss of funds invested. It should not be assumed that any recommendations made will be profitable or equal the performance noted in this publication.

The information herein is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Magnolia Growth Capital LLC (referred to as “MGC”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

All opinions and estimates constitute MGC’s judgement as of the date of this communication and are subject to change without notice. MGC does not warrant that the information will be free from error. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall MGC be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the information provided herein, even if MGC or a MGC authorized representative has been advised of the possibility of such damages. Information contained herein should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.