Why Invest in Japan: An Investor’s Perspective

Japan offers surprising investment potential for investors looking for opportunities outside of US. Its public transportation system doubles as a thriving economic hub, while the government is actively driving a shift towards a consumer-driven economy. This creates exciting opportunities in sectors like retail, consumer goods, and green/digital transformation. Look beyond the headlines and discover the hidden potential of this dynamic nation.

My recent 30-day exploration of the Japanese economy left me profoundly appreciating this unique nation. My reasons to visit the country were to witness the economy of Japan as I plan to expand my investment expertise beyond the US and take the first step towards making Magnolia Growth Capital a truly global investment management firm. Beyond the headlines, I experienced a country that offers compelling lessons for investors looking to diversify and anyone interested in social and economic models for the future. Here are my key reasons why investing in Japan now in 2025 makes sense:

A Society Defined by Harmony, Safety, and Respect

The first striking aspect of Japan is how safe and courteous everyone is. As an outsider, I felt immediately welcomed. From the bustling streets of Tokyo to serene villages, the social atmosphere was marked by kindness, respect, and an unwavering commitment to maintaining order. This harmonious environment extends beyond the tourist areas and deeply permeates everyday life.

Unlike many Western nations where crime and visible homelessness have become persistent post-pandemic problems, in Japan, I saw virtually no homelessness. Safety prevails in both vibrant cities and remote towns; it’s not unusual to see people out at 3 am with minimal concern.

Public Transit as the Heart of the Economy

Japan’s public transportation system transcends mere travel; it’s a marvel in its own right. The efficient subway networks and iconic Shinkansen bullet trains seamlessly connect the country, making navigation a breeze. But that’s not all. Imagine stepping off the train and being greeted by a vibrant array of shops, cafes, and even luxury brands like Louis Vuitton and Bulgari., maximizing business exposure. Advertising on transit vehicles, which might seem unusual elsewhere, becomes a stroke of marketing genius in Japan due to the sheer volume of commuters. Ritz-Carlton wouldn’t be out of place here – it’s a prime example of how brands capitalize on this captive audience.

Shinkansen bullet train speeding through the Japanese countryside with Mount Fuji in the background

Shinkansen bullet train speeding through the Japanese countryside with Mount Fuji in the background

Commutes, Mobile Gaming, and Targeted Advertising

Japan’s extensive reliance on public transportation significantly shapes consumer behavior, particularly regarding gaming. Unlike car-dependent cultures like the US, where console gaming dominates the gaming industry, Japan’s long commutes on trains and subways fuel a thriving mobile gaming industry. These captive audiences on the go present a prime opportunity for targeted advertising. Video game companies capitalize on peak travel times with targeted promotions, maximizing engagement with a demographic constantly on the move.

A Thriving Pop Culture Phenomenon

Japan dominates storytelling in comics (manga) and animation (anime). This isn’t just a niche market; I observed dedicated shops packed with patrons of all ages—with women surprisingly being the more dominant consumers. These cultural products have far-reaching economic implications in influencing fashion, gaming, and merchandise.

Service Excellence and the Importance of Dedication

The Japanese commitment to quality work is undeniable, regardless of the profession. While tipping is not part of the culture, service remains top-notch. Small, family-run establishments are surprisingly common even in highly developed areas. The lack of reliance on online reviews creates a refreshing dynamic where personal reputation within the community carries far more weight.

Order and Reliability as National Core Values

Japan sets a benchmark for social reliability and punctuality. The experience transcends everyday interactions and permeates infrastructure—transportation, in particular, adheres to meticulous scheduling. Compared to other developed nations, even the police have a less intimidating presence, fostering greater societal trust.

Rethinking Stagnation and Opening to the World

Japan has long grappled with a stagnant economy and low birth rates, but a positive shift is underway. The country is relaxing immigration policies to boost innovation and counter labor shortages. These changes, alongside inflationary pressures, are driving a focus on wage increases. In 2024, Japan is transitioning from supply-side inflation to a demand-driven scenario where wage growth stimulates consumer spending. Echoing the BOJ, Prime Minister Kishida’s focus on a “new form of capitalism” sees wage hikes as essential for higher consumption and allowing firms to raise prices.

Labor Market Dynamics and the Role of SMEs

Japan’s unique labor management system features lifetime employment, seniority-based wages, and robust enterprise unions with a nationwide unionization rate of about 20%. Wage negotiations are crucial, with unions demanding at least a 5% increase for the upcoming fiscal year. Large employers like Suntory are proactively raising wages to compete for talent. However, Small and Medium-sized Enterprises (SMEs), which employ 70% of the workforce, struggle to pass on rising labor costs, hindering wage growth across the economy.

Government Intervention and the Power of Big Business

The Japan Fair Trade Commission (JFTC) is pressuring large corporations to support fair pricing practices with SMEs to address this imbalance. New government guidelines encourage fairer negotiations and combat anticompetitive behavior by large corporations. The goal is to ensure the entire supply chain benefits from price adjustments, ultimately supporting wage growth. These initiatives aim to break Japan’s deflationary mindset and increase price pass-through, particularly for labor-intensive SMEs. Large, profitable companies are urged to support SMEs by accepting higher prices, enabling a healthier economy. The government’s goal to significantly increase the minimum wage also signals a positive shift towards higher median salaries and greater consumer spending.

Investors should look favorably on sectors likely to benefit from this evolving landscape, such as retail, consumer goods, and services, as well as green and digital transformation, as key growth drivers.

Latent Power and Defense Strategies

It would be remiss to discuss Japan without touching on its unique position regarding nuclear defense. While it possesses no active nuclear weapons program, Japan has a complete fuel cycle, advanced technology, and could theoretically develop nuclear weapons rapidly. This positions Japan as a latent nuclear power, alongside its unique geography as an island nation that provides a formidable natural defense.

The Shifting Tides: Why Japan’s Investment Landscape is Changing

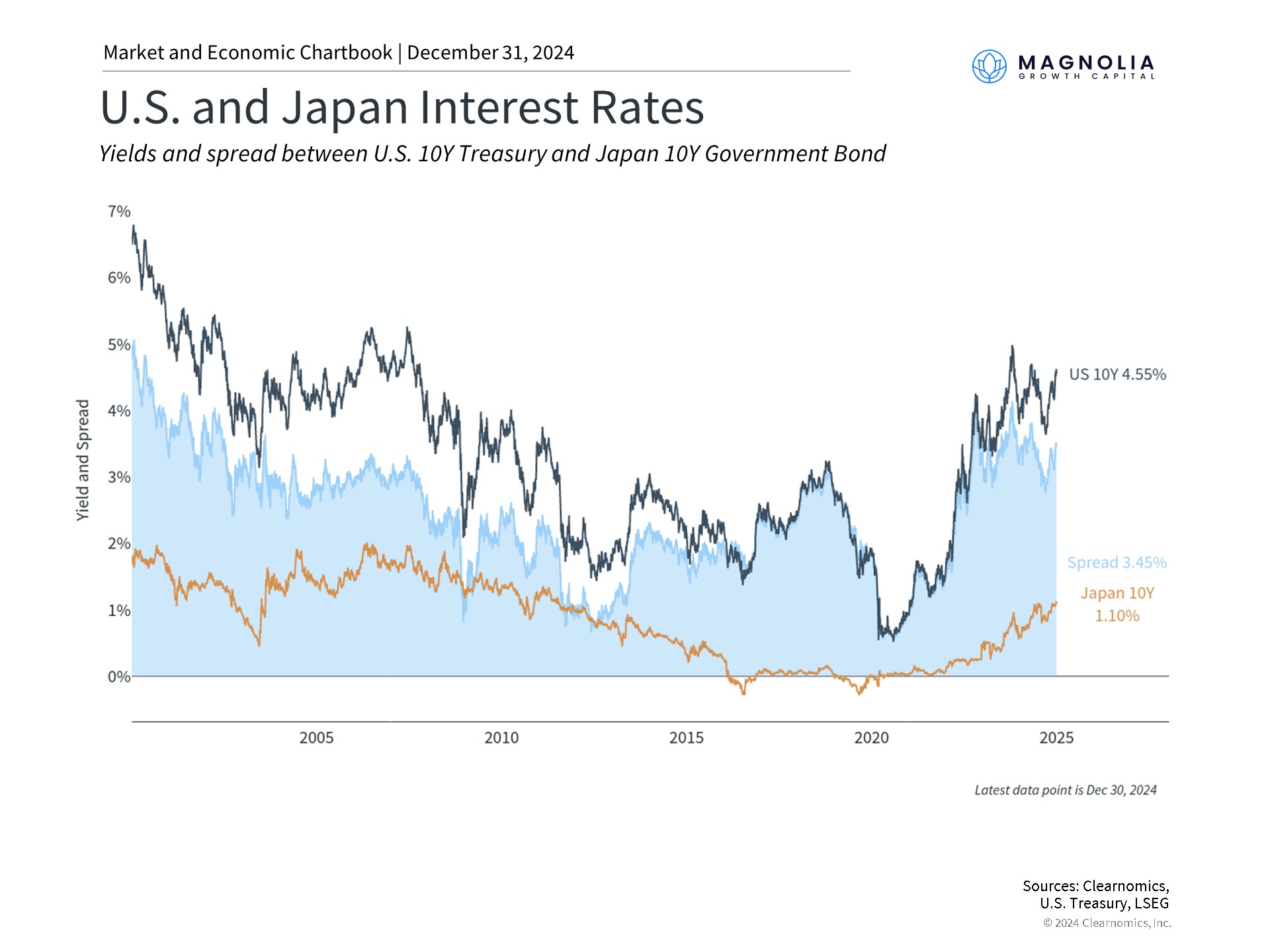

For decades, a significant gap has existed between U.S. and Japanese interest rates. This difference fueled the popular “carry trade,” where investors borrowed money in Japan at low rates and invested it in higher-yielding U.S. assets. However, as the chart below illustrates, this dynamic is starting to shift.

The Bank of Japan (BOJ) has begun to raise interest rates, albeit gradually, narrowing the spread between U.S. and Japanese yields. This potential for changing tides in the carry trade, coupled with other factors, makes Japan an increasingly attractive investment destination.

Why This Matters for Investors:

- Increased Returns: As Japanese interest rates rise, so too can the potential returns on Japanese assets.

- Currency Appreciation: A narrowing interest rate differential could lead to an appreciation of the Japanese yen, further boosting returns for foreign investors.

- Reduced Risk: Diversifying into Japanese assets can help reduce portfolio risk, particularly as correlations between U.S. and Japanese markets may weaken.

This shift in the interest rate environment, combined with Japan’s ongoing economic reforms, commitment to innovation, and cultural strengths, creates a compelling case for investors as to why invest in Japan now in 2025. Take a closer look at the Land of the Rising Sun.