Why is diversification a recommended investment strategy? Explore European Stocks

When we think about Europe, images of delectable cheeses, rich chocolates, fine wines, and ancient Roman ruins often come to mind. But have you ever considered Europe as a prime investment opportunity? While the US has dominated the global stock market for the past decade, recent trends suggest it’s time to diversify beyond its borders.

Despite its strengths in social inclusion, climate action, and robust social safety nets, the EU has lagged behind the US in economic growth. This gap is largely attributed to slower productivity growth stemming from lower R&D investment and a focus on “middle technology” industries. However, the EU is now undergoing a period of transformation, driven by a renewed focus on innovation, strategic investments in key sectors, and a push to streamline its regulatory landscape. This presents a unique opportunity for long-term investors looking to diversify their portfolios and capitalize on the EU’s potential for a comeback. Keep reading to discover the driving forces behind this transformation and the sectors poised to benefit most

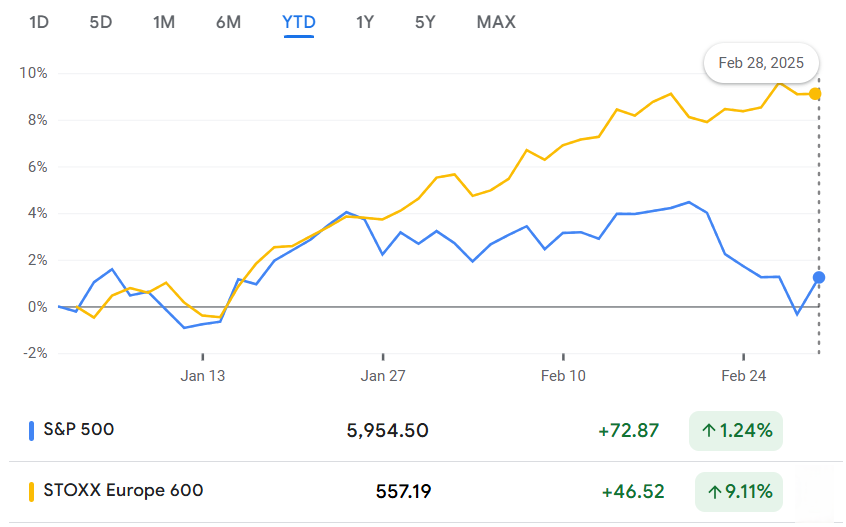

Diversification remains a cornerstone of sound investment strategies. While the US has dominated markets for the past decade, recent trends suggest exploring opportunities beyond its borders. Notably, European stocks have outperformed the S&P 500 year-to-date, partly due to perceived weaknesses in the US tech sector and the EU’s renewed focus on safeguarding its economic interests in the face of intensifying global competition. This begs the question: is Europe finally ready for a comeback?

Many investors are wondering, “Why is diversification a recommended investment strategy?” The answer lies in mitigating risk. While the US market has shown strong performance historically, concentrating all your investments there exposes you to potential market corrections. Diversifying into other markets, like the EU, can help reduce your overall portfolio risk.

Source: Google Finance

The European Union Economy

To assess the EU’s potential, we need to understand its economy which in investing is the Gross Domestic Product (GDP).

The main components of GDP are Consumption (C), Investment (I), Government Spending (G), and Net Exports (NX = Exports minus imports).

GDP = C + I + G + NX

Consumption (C)

The EU’s single market, encompassing 27 member states with free movement of goods, services, capital, and people, fosters economic cooperation. However, only 20 members have adopted the euro, creating some economic fragmentation.

Household finances play a crucial role in consumption

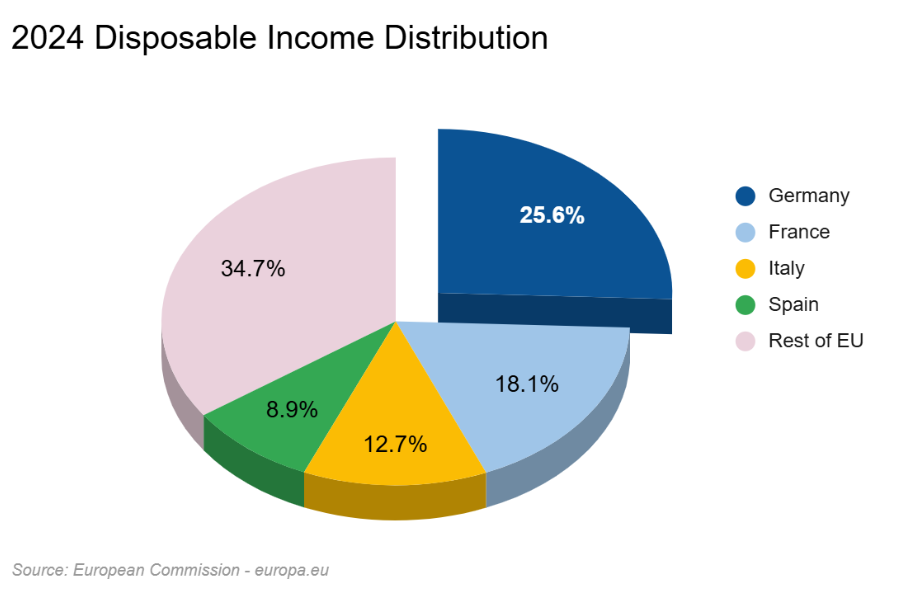

Disposable Income Distribution: Germany accounts for the largest share (25.6%) of the EU’s gross household disposable income, followed by France (18.1%), Italy (12.7%), and Spain (8.9%).

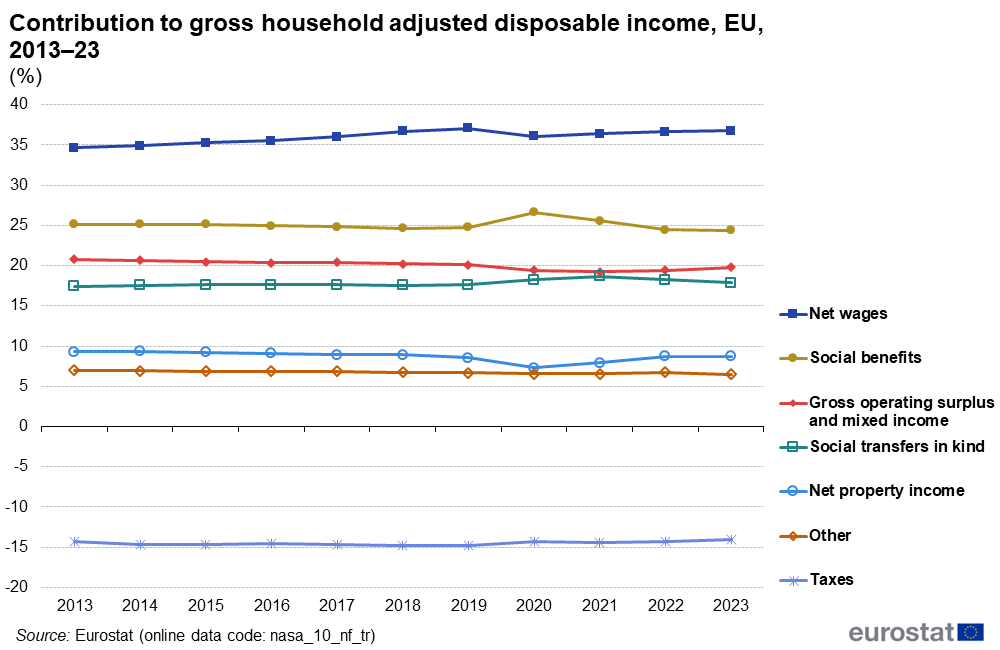

- Sources of Income: Net wages, gross operating surplus, and mixed income account for 56.6% of disposable income, while social benefits and transfers in kind contribute 42.2%.

Households in the EU save a significant portion (13.2%) of their disposable income. In 2023, household expenditure accounted for 52.1% of GDP, highlighting its role as the largest contributor to economic activity

Investment (I)

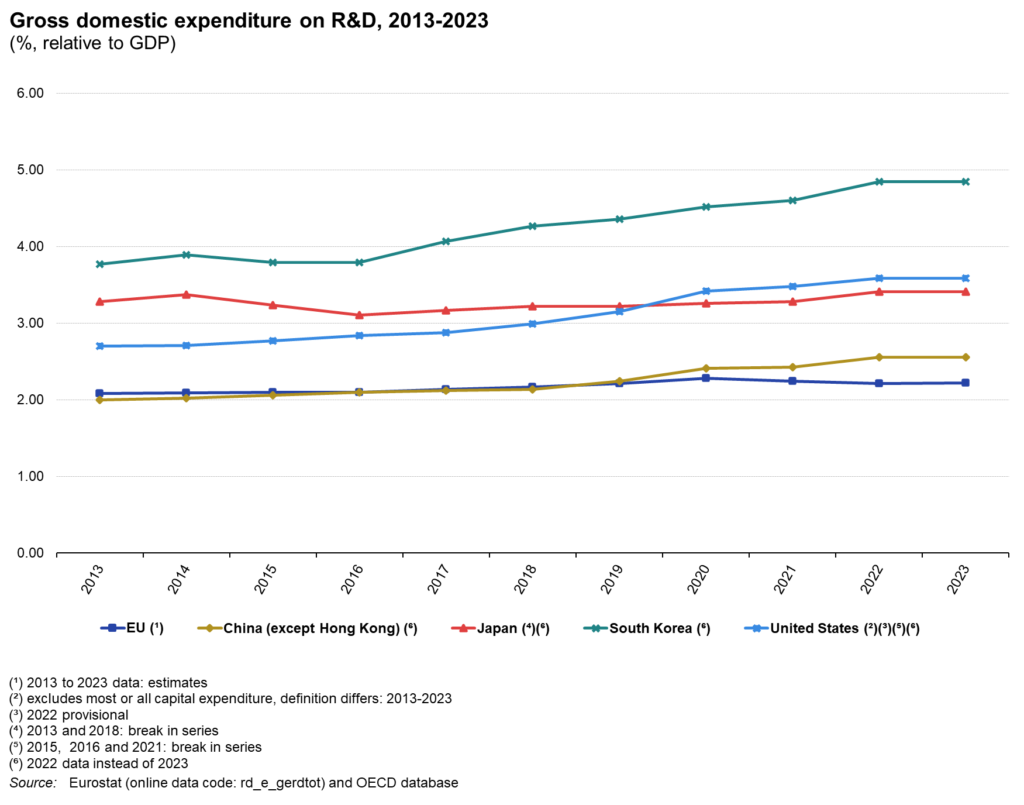

The EU has lagged behind the US in market performance over the past two decades. A key factor is the EU’s focus on “middle technology” industries with lower R&D intensity, such as the automobile industry, which has been a consistent leader in the Western European market. This contrasts with the United States’ dynamic shift towards high-growth sectors fueled by robust R&D spending, information and communication sector, and pharmaceuticals. The top US companies have transitioned from automobile and pharmaceutical giants in the 2000s to tech behemoths like Alphabet, Nvidia, Meta, and Microsoft in the 2020s.

In fact, there is no EU company with a market capitalization over EUR 100 billion that has been set up from scratch in the last fifty years, while all six US companies with a valuation above EUR 1 trillion have been created in this period. This lack of dynamism is self-fulfilling.

This “middle technology trap” is reflected in the EU’s lower R&D expenditure:

- R&D Investment: In 2023, the EU allocated 2.2% of its GDP to R&D, compared to 3.6% for the US, 3.4% for Japan, 4.9% in South Korea and 2.5% for China.

While R&D is just one component of GDP, it’s a crucial indicator of innovation. Innovation acts as a catalyst, driving up productivity, which in turn fuels higher household incomes and stimulates domestic demand.

Net Exports (NX)

The EU has historically benefited from a favorable global environment, including the “peace dividend” of US hegemony and multilateral trade agreements. This led to a significant increase in international trade as a share of GDP:

- Trade Growth: International trade increased to 43% of GDP in 2019, up from 30% in 2000.

The EU has historically enjoyed strong trade relationships with both China and the US, absorbing excess Chinese production while exporting its own goods and services, particularly to the US market.

However, rising protectionism, geopolitical tensions (particularly the Ukraine conflict), and increased competition from China threaten this model.

- Competition with China: The share of sectors in which China directly competes with the EU has risen from 25% in 2002 to 40% in 2023. The EU is facing challenges in sectors like clean tech and automotive due to competition from China, which benefits from state subsidies and industrial policy.

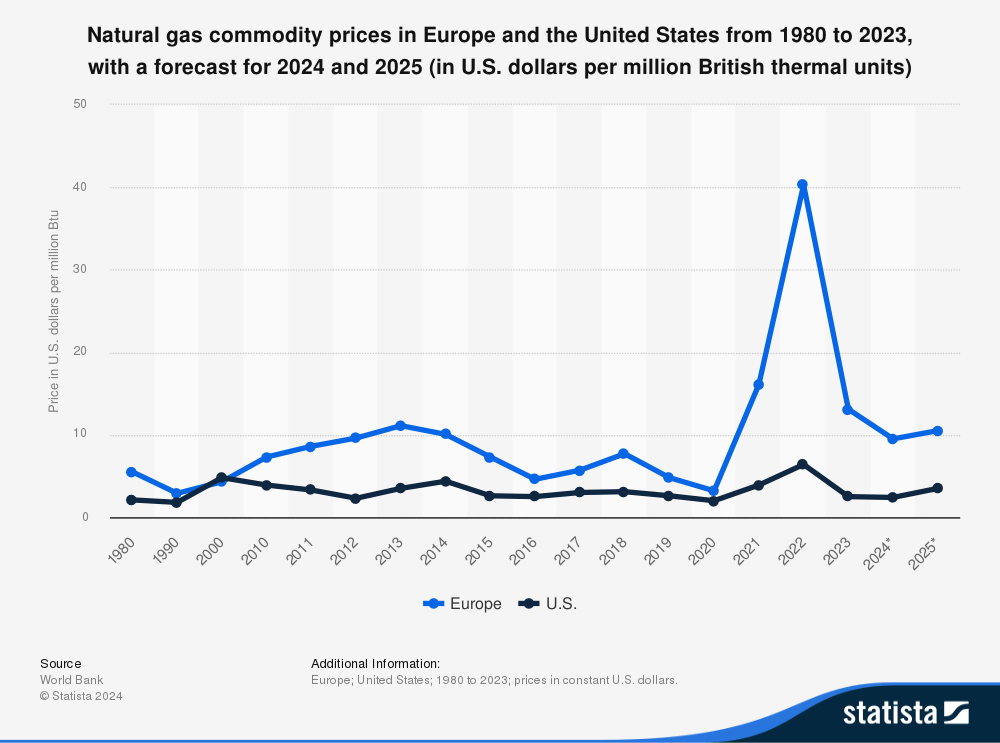

- Challenges with Russia: The Russia-Ukraine conflict has disrupted EU energy imports, particularly natural gas. Pipeline gas from Russia, which accounted for 45% of EU imports in 2021 and provided a source of relatively cheap energy, has been significantly curtailed.

Source: World Bank and Statista

Even with the recent decline in energy prices, EU companies still face electricity prices that are 2-3 times higher than those in the US. Natural gas prices in the EU remain a staggering 4-5 times higher than US levels. This disparity undermines the competitiveness of EU industries, particularly those with high energy consumption, impacting their ability to compete in global markets for exports.

Government Spending (G)

It’s important to understand the overall landscape of government expenditure in the EU. In 2022, general government total expenditure in the EU amounted to 49.6% of GDP, influenced by pandemic-related measures and efforts to mitigate the impact of rising energy prices.

Social safety net remains the most significant area of expenditure, accounting for approximately 20% of GDP. Followed by health (7.7% of GDP), general public services (6.0%), such as public debt transactions, economic affairs (5.9%), and education (4.7%). Defense expenditure stood at 1.3%.

The EU’s biggest challenge lies in its fiscal fragmentation. Unlike the US with its centralized fiscal policies, the EU’s member states retain significant fiscal autonomy. This leads to:

- Fiscal Fragmentation: Unlike the unified fiscal policy of the US, the EU’s member states retain significant fiscal autonomy, leading to fragmented policies and incompatible standards across the bloc. This can be likened to a “global film festival where every nation has veto power over the popcorn.”

- Fragmented Capital Pools: This lack of coordination hinders the creation of large capital pools necessary for funding breakthrough technologies. Investment and financing become fragmented along national lines, with wealthier countries providing more generous support, exacerbating disparities.

- Lack of Coordinated Industrial Policy: The US and Japan employ coordinated industrial policies, combining fiscal incentives, trade policies, and strategic investments to support key sectors and secure supply chains (for example: the Inflation Reduction and Bipartisan Infrastructure Acts). The EU, however, lacks such a comprehensive approach, leaving critical industries vulnerable to global competition.

- Over-Reliance on Private Sector: Unlike its competitors, the EU largely leaves the mining and trading of commodities to private actors, lacking a cohesive strategy for managing critical raw materials and supply chains from exploration to recycling.

A Contrarian View and Diversification Opportunity:

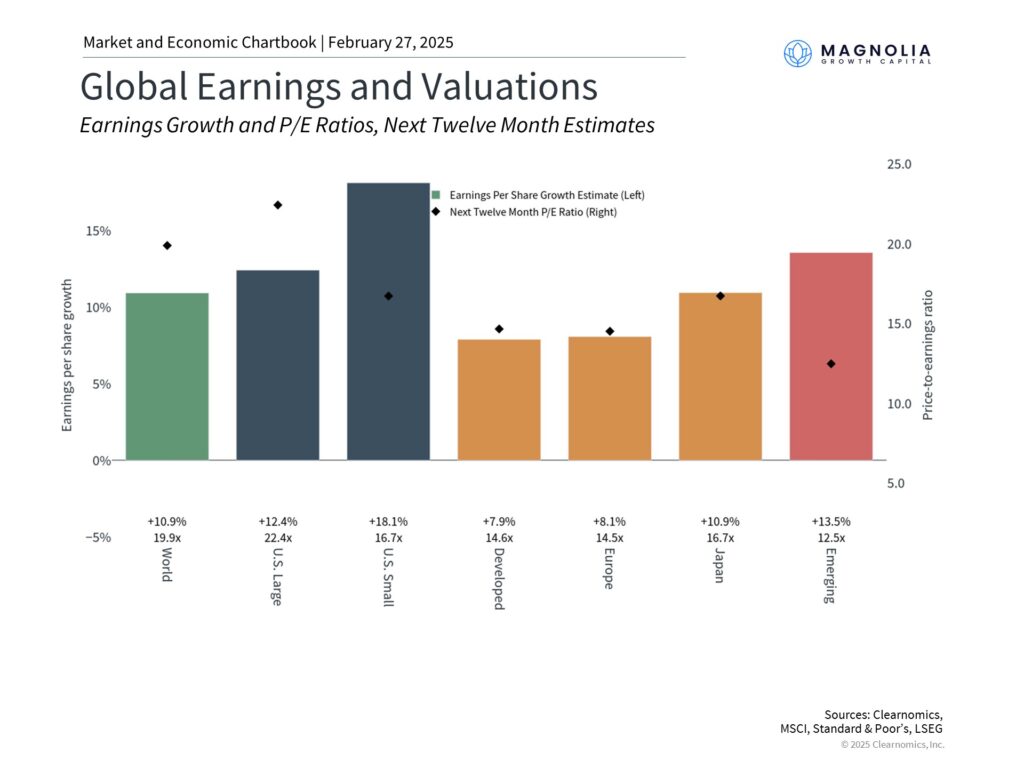

While concerns about the US market’s overvaluation and the EU’s challenges persist, a contrarian perspective reveals a compelling case for diversification and potential investment opportunities in Europe.

Why should you diversify?

- US Market Overvaluation: Many market analysts suggest that the US market is overvalued, particularly in the technology sector, which carries a higher price-to-earnings ratio compared to European benchmarks. This overvaluation increases the risk of a market correction, making diversification into other markets a prudent strategy.

- EU’s Undervalued Potential: Despite its challenges, the EU possesses numerous strengths, including its commitment to democratic values, a skilled workforce, and a large consumer market. The EU’s current economic and geopolitical landscape may present an opportunity to invest in potentially undervalued assets.

The EU’s Strengths and Challenges: A Balancing Act

The European Union stands as a formidable economic power, boasting a large consumer market, a skilled workforce, and strong democratic foundations. Its leadership in key sectors like clean technology and high-end manufacturing further solidifies its global position. However, the EU also faces significant challenges that have hindered its growth and dynamism in recent decades.

Strengths:

- Strong Democratic Foundations: The EU’s commitment to democratic values fosters stability and transparency, creating a favorable environment for long-term investment and economic development.

- Skilled Workforce: Europe boasts a highly educated and skilled workforce, providing a strong foundation for innovation and productivity growth.

- Large Consumer Market: The EU’s single market, with over 448 million consumers, offers significant opportunities for businesses to scale and reach a vast customer base.

- Leadership in Key Sectors: The EU is a global leader in clean technology, high-end manufacturing, and other sectors, providing a competitive edge in these growing markets.

Challenges:

- Bureaucracy and Red Tape: The EU’s complex regulatory environment and bureaucratic hurdles can stifle innovation and hinder the growth of businesses, particularly startups and scale-ups.

- Underdeveloped Financing Arrangements: Access to capital remains a challenge for many European businesses, particularly those in the early stages of development. The lack of robust venture capital and private equity markets compared to the US limits the growth potential of innovative companies.

- Lack of Dynamic New Companies: The EU has seen fewer major new companies emerge in recent decades compared to the US and other regions. This lack of dynamism reflects challenges in scaling businesses and fostering a culture of disruptive innovation.

How is the EU addressing the Innovation Gap

The EU is at a critical juncture, recognizing the urgent need to bolster its innovation capacity and competitiveness on the global stage. To address this, the EU is implementing a series of significant changes:

1. Fostering a Culture of Innovation:

- AI Initiatives: Recognizing the transformative potential of artificial intelligence, the EU is launching “AI Gigafactories” and “Apply AI” initiatives to drive the development and industrial adoption of AI in key sectors.

- Advanced Technology Action Plans: Beyond AI, the EU is developing action plans for advanced materials, quantum technologies, biotechnology, robotics, and space technologies. These plans aim to foster growth and innovation in these cutting-edge fields, ensuring the EU remains at the forefront of technological advancement.

2. Streamlining the Regulatory Landscape:

- “Competitiveness Compass”: The EU acknowledges that its complex regulatory environment can hinder innovation. The “Competitiveness Compass” initiative focuses on simplifying regulations and removing barriers in the Single Market, aiming to reduce red tape for businesses, particularly those in innovative sectors like AI. However, navigating the EU’s deeply ingrained precautionary principle, especially in sensitive areas like AI, will require a delicate balance between fostering innovation and ensuring responsible development.

3. Supporting Startups and Scale-ups:

- EU Start-up and Scale-up Strategy: Europe has the talent and ideas but often struggles to translate innovation into commercial success. This strategy addresses obstacles hindering the emergence and growth of new companies, aiming to create a more dynamic and entrepreneurial ecosystem. This includes tackling issues like access to finance, fragmented markets, and regulatory complexities that often drive European entrepreneurs to seek funding and scale-up opportunities in the US.

4. Unlocking Capital and Deepening Capital Markets:

- Savings and Investments Union (SIU): The EU recognizes the need for deeper and more integrated capital markets to fuel innovation. The SIU aims to unlock private capital for investment, particularly through the development of pension funds. This will address the underdevelopment of pension funds in the EU, where in 2022 the level of pension assets was only 32% of GDP compared to 142% in the US and 100% in the UK. The SIU aims to stimulate the growth of private pension systems across the EU by creating a more favorable regulatory environment for pension funds and encouraging individuals to save for retirement through private schemes. This will help channel more long-term capital into EU capital markets, providing the “patient capital” needed to fund innovation and sustainable development.

5. Simplifying Cross-Border Business Operations:

- Proposal for a 28th Legal Regime: To address the complexities of navigating 27 different national legal systems, the EU is proposing an optional, unified legal framework. This “28th legal regime” would simplify rules for innovative companies, streamlining procedures and making the EU a more attractive investment destination. By offering a standardized legal environment, this initiative aims to reduce administrative burdens, foster innovation, and enhance the EU’s competitiveness.

6. Embracing Decarbonization and Sustainability:

- Clean Industrial Deal: The EU is committed to decarbonization and aims to lead the way in clean technologies. The Clean Industrial Deal promotes a competitive approach to decarbonization, supporting clean tech and circular business models. This includes strategic investments and subsidies, a focus on innovation and efficiency, a robust regulatory framework, and global collaboration to ensure the EU’s clean tech sector can compete effectively with China and other global players. To achieve this, the EU is mobilizing significant funding for clean tech development and deployment, including through the Innovation Fund and the proposed Industrial Decarbonization Bank, aiming for €100 billion in funding.

7. Ensuring Affordable and Secure Energy:

- Affordable Energy Action Plan: Addressing the challenges posed by the energy crisis, this plan aims to reduce energy prices and costs. This includes reforming energy markets, investing in infrastructure, and implementing policies to promote renewable energy sources and decouple electricity prices from volatile natural gas prices.

- Industrial Decarbonization Accelerator Act: To facilitate the energy transition, this act will extend accelerated permitting to sectors undergoing decarbonization, supporting crucial industries like steel, metals, and chemicals.

8. Strengthening Security and Resilience:

- Review of Public Procurement Rules: To promote strategic autonomy and support domestic industries, the EU is reviewing public procurement rules to allow for European preference in critical sectors and technologies.

- Increased Defense Spending and Cooperation: In response to the changing geopolitical landscape, the EU is increasing defense spending and bolstering its defense capabilities through initiatives like the European Defense Fund (EDF) and Permanent Structured Cooperation (PESCO). Several EU member states have already announced significant increases in their defense budgets, with some aiming to reach or exceed the NATO target of 2% of GDP.

Where to invest in the European Union?

Investors often ask, ‘What stocks to invest in?’ When it comes to the EU, consider the bloc’s strategic priorities. The EU’s focus on innovation, sustainability, and security suggests that companies in sectors like clean technology, robotics, defense, and banking could be attractive investment options. Let’s explore them in detail:

1. Clean Technology: Riding the Green Wave

Europe is a global leader in decarbonization technologies, and its commitment to clean energy is unwavering. With the US shifting its focus towards natural gas and other non-renewable sources, the EU has a unique opportunity to capitalize on the burgeoning clean tech industry. Climate-conscious citizens and growing demand for clean technologies will drive growth in this sector. Furthermore, the proposed energy market reforms, including decoupling electricity prices from volatile natural gas prices, will significantly benefit clean tech companies by reducing energy costs and promoting investment in renewable energy sources.

2. Cloud Computing and Robotics: Embracing Digital Transformation

While fostering AI and semiconductor industries from scratch may be a costly endeavor, the EU recognizes its strengths in other areas of digital technology. When considering the best stocks to invest in 2025, it’s essential to look beyond the usual suspects. The EU’s focus on clean technology, ‘Sovereign Cloud’ solutions, and robotics presents compelling opportunities. Companies in these sectors are well-positioned to benefit from the EU’s economic transformation and could deliver strong returns for investors. By integrating AI into its existing industrial base and leveraging its robotics expertise, the EU can achieve significant productivity gains and drive innovation in its “middle technology” industries.

3. Defense: A New Era of Cooperation

With increasing geopolitical uncertainties and the US shifting its focus towards the Pacific, the EU is prioritizing its security and defense capabilities. Increased defense spending by member states and joint collaboration among nations will create a surge in demand for the defense sector. Moreover, as history has shown with initiatives like DARPA in the US, defense spending often leads to significant technological advancements and innovation, further benefiting the industry.

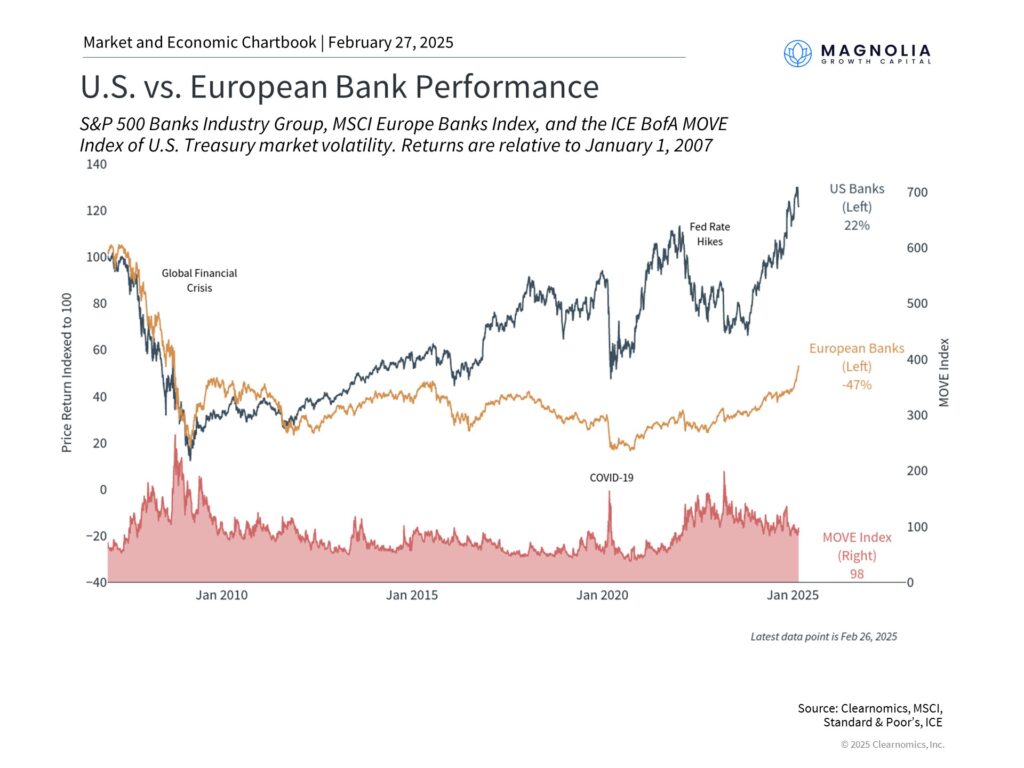

4. Banking: Financing the Future

The period of negative interest rates in the EU (roughly 2014 to 2022) significantly impacted the performance of EU banks, contributing to a divergence from their US counterparts. This, along with challenges like higher capital requirements, a sluggish economy, and legacy issues, hindered their growth. The EU’s ambitious initiatives require substantial investment and financing. This creates a favorable environment for the banking sector, which will play a crucial role in underwriting and securitizing loans, supporting strategic sectors, and incentivizing risk-taking. The banking sector is well-positioned to benefit from the EU’s economic transformation and contribute to its long-term growth.

For investors seeking broader exposure to the EU market, the best funds to invest in may be those focused on European equities or specific sectors poised for growth, such as clean energy, technology, and healthcare. These funds offer a diversified approach to investing in the EU’s potential.

The Path Forward: A Contrarian Opportunity

The EU is actively addressing its weaknesses and leveraging its strengths to become a more competitive and innovative economy. While challenges remain, these reforms and initiatives signal a turning point for the EU, creating a compelling opportunity for investors seeking diversification and potentially good returns in the long term. The Euro, as a stable and less manipulated currency, offers a safer alternative compared to emerging markets, potentially providing better risk-adjusted returns for investors.

By strategically allocating investments in these key sectors, investors can potentially capitalize on the EU’s growth trajectory and contribute to its economic resurgence. The EU’s commitment to sustainability, innovation, and security, coupled with its proactive reforms, makes it an attractive destination for those seeking long-term investment opportunities.

Key References:

“Clean Industrial Deal – European Commission.” 2025. European Commission. https://commission.europa.eu/topics/eu-competitiveness/clean-industrial-deal_en.

Draghi, Mario. n.d. “The Draghi report on EU competitiveness.” European Commission. Accessed February 2, 2025. https://commission.europa.eu/topics/eu-competitiveness/draghi-report_en.

“EU competitiveness – European Commission.” n.d. Competitiveness Compass. Accessed January 5, 2025. https://commission.europa.eu/topics/eu-competitiveness_en.

European Commission – Digital Strategy. n.d. “European approach to artificial intelligence | Shaping Europe’s digital future.” Shaping Europe’s digital future. Accessed January 6, 2025. https://digital-strategy.ec.europa.eu/en/policies/european-approach-artificial-intelligence.

European Commission – Eurostat. 2024. “Government expenditure by function – COFOG – Statistics Explained.” European Commission. https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Government_expenditure_by_function_%E2%80%93_COFOG.

“European Defence Fund (EDF) – Official Webpage of the European Commission. – European Commission.” n.d. Defence Industry and Space. Accessed March 2, 2025. https://defence-industry-space.ec.europa.eu/eu-defence-industry/european-defence-fund-edf-official-webpage-european-commission_en.

“Permanent Structured Cooperation (PESCO) | EEAS.” n.d. EEAS. Accessed March 2, 2025. https://www.eeas.europa.eu/eeas/permanent-structured-cooperation-pesco_en.

Strupczewski, Jan, and Ed Osmond. 2025. “Commission wants pan-EU rules for innovative firms to leverage EU single market.” Reuters, January 21, 2025. https://www.reuters.com/markets/europe/commission-wants-one-set-rules-across-eu-innovative-firms-2025-01-21/.