Trump, Taxes, and Tariffs: A 2025 Guide for Investors

The December 2024 jobs report exceeded market’s expectations, but the stock market reacted negatively due to concerns about potential interest rate cuts this year. Donald Trump is set to become President next week and the policies set forth by the new administration could lead to higher inflation. Long-term bond yields are flashing warnings signs and has created uncertainty in the market, particularly impacting 10, 20, and 30-year treasuries and growth stocks. Consumer defensive, certain industrial, and financial sectors are expected to perform well in 2025.

256,000 new jobs – this is a number that should have sent the stock market soaring.

Instead, it took a nosedive. What gives?

Last December’s jobs report blew past expectations. Labor market data showed the US economy added 256,000 jobs in December of 2024 yet the consensus expectations was only 155,000. While the report confirms that things are really humming in the economy, there was a disconnect between the news and how the stock market and bond yields reacted.

Why would the market react negatively to strong job reports?

Shouldn’t strong job numbers be good for the economy and the stock market? Not exactly. The market works on a series of future expectations related to the interest rate environment. Job numbers are among the most important economic indicators in markets, in large part because they help shape expectations for monetary policy set by the Federal Reserve.

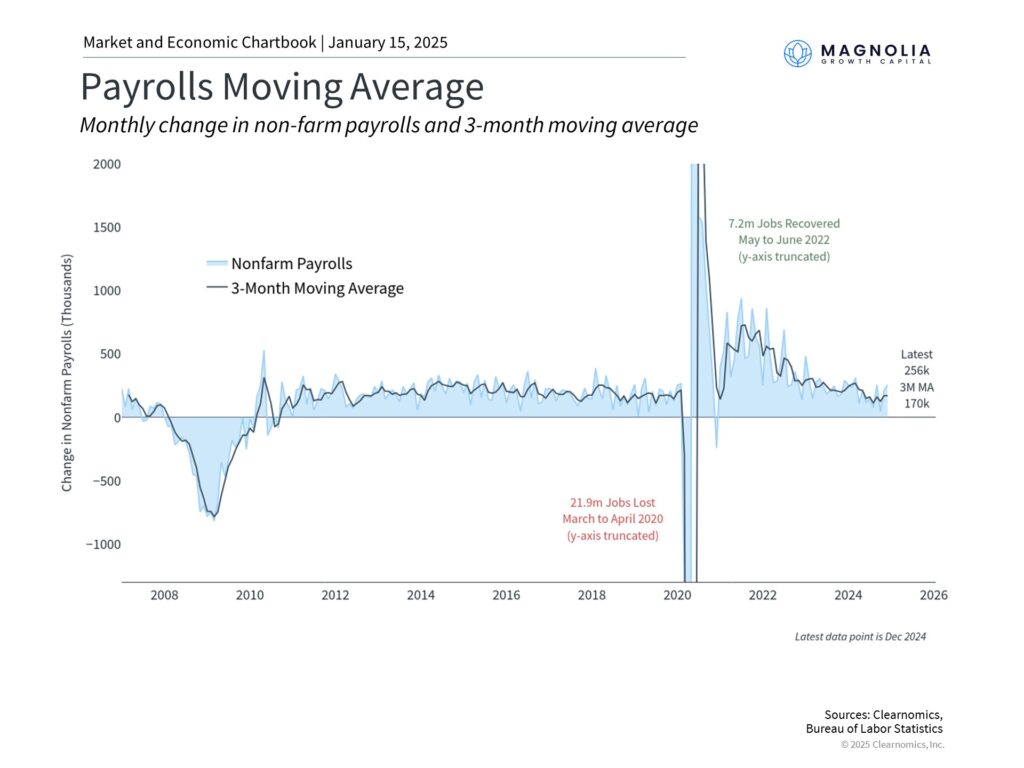

In 2024, the Federal Reserve cut interest rates 3 times to a total of 100 basis points, setting the interest rates to 4.25%. The rate cuts in 2024 were prompted because of the slight increase in unemployment rate to 4.1%, weakening job markets, and also because inflation was getting under control. The chart below shows how extreme job markets became after the COVID-19 pandemic and the rebound jobs at today.

Yet the new policies put forth by The Trump administration after the most recent elections, including higher tariffs on imports and lower taxes, have many economists projecting a stronger economy with higher inflation and interest rates for longer.

For simplicity, let’s break these concepts down a little bit. Higher tariffs mean higher production costs for corporations and lower taxes means more money in your pockets.

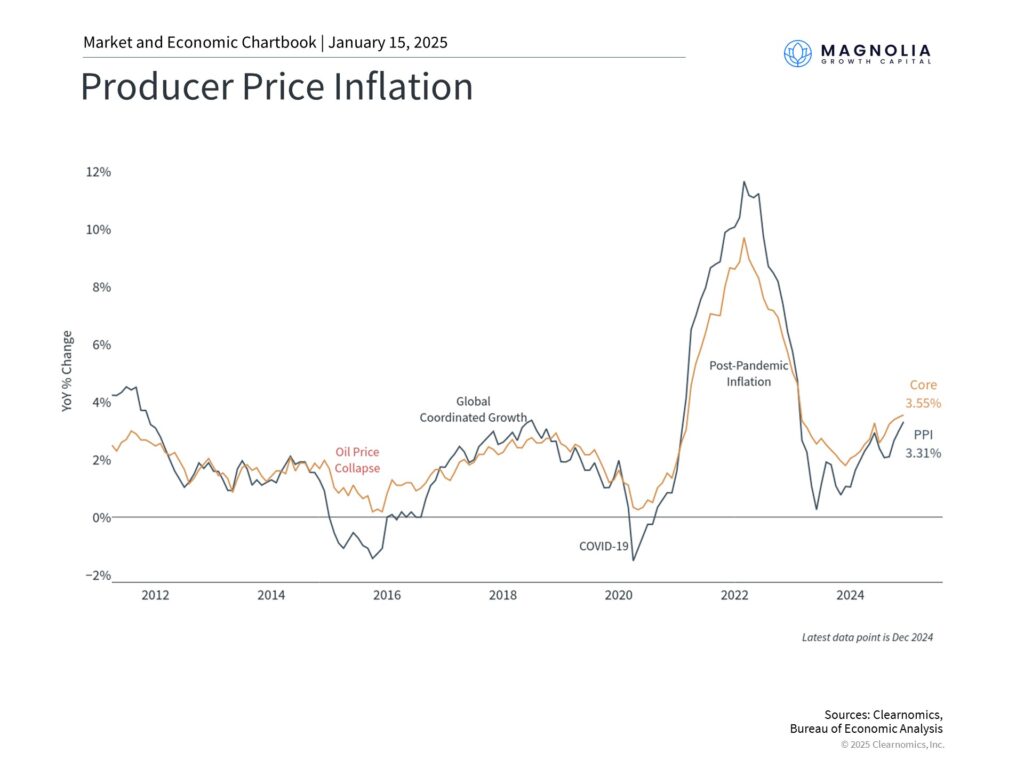

If businesses know you have more money in your pockets, then the higher production costs they pay due to tariffs means they can increase the prices on the goods and services they sell to you. This is a classic case of higher inflation. Look at the chart below and how the cost of goods paid by the producers (Producer Price Inflation) and higher household savings rate (thanks to COVID-19 stimulus checks) led to post-pandemic inflation.

Connecting the dots – Federal Reserve, Tariffs, Inflation, and Lower Taxes

Now the Federal Reserve has a dual mandate set forth by Congress to maintain stable prices for consumers and low unemployment. If Fed board officials expect price pressures on consumers, then they will keep the interest rates where they are or may even increase them. The market currently expects two rate cuts for 2025, but if they start seeing solid job numbers along with higher prices for consumers throughout the year, then it’s likely that these rate cuts will never materialize. This is already becoming evident in how the stock market and the bond yields are behaving.

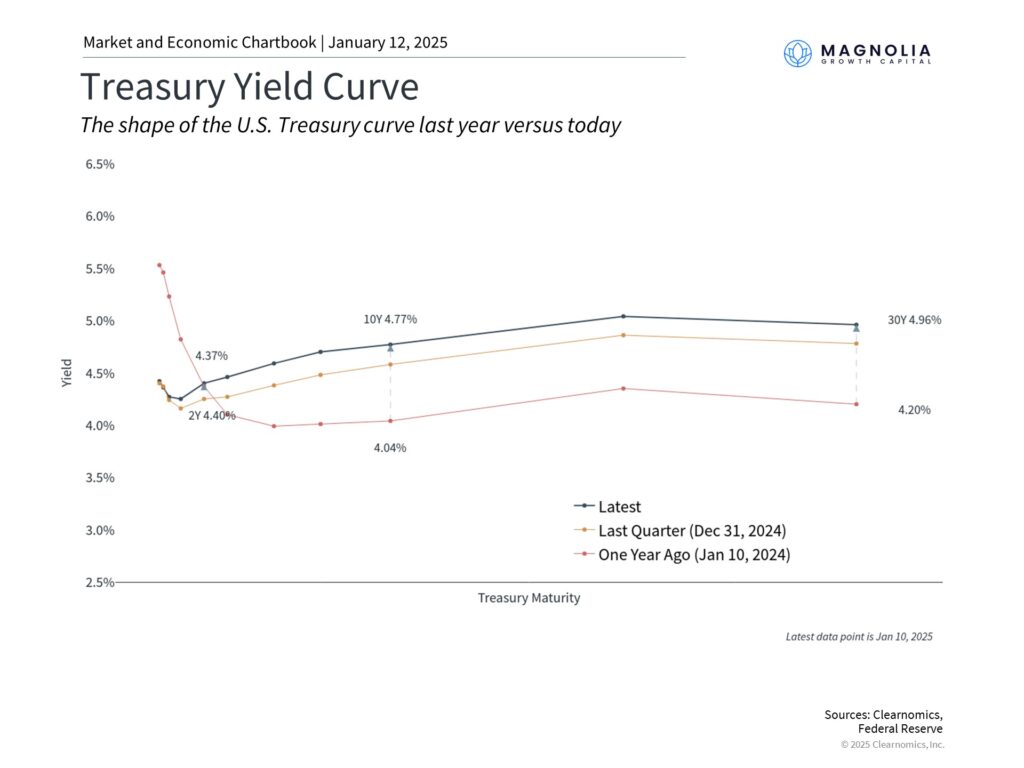

Looking at the chart below – long term yields on the 10, 20, and 30-year treasuries are increasing and when yields increase, bond prices fall.

Our prediction is with the US government running deficits and more tax cuts around the horizon, we expect the yield curve to steepen furthermore. Term premium (a.k.a. yields bond investors’ demand for holding long-term bonds) across the globe for developed markets like UK, France, Germany, and Japan is also increasing. But counterintuitively, bonds are also the safest place to invest amid the recession or market and economic shocks. This is mainly because bonds offer principal protection and predictable returns while stocks are in free fall due to declining corporate profits and economic distress. It’s hard to predict when or where these shocks can occur. You can still mitigate your investment risk and protect your portfolio of investments by diversifying across asset types and duration. For a primer on investing in fixed income, refer to our previous post.

What does this all mean to investors?

Investing in Fixed Income

In our opinion, for investors looking to invest in fixed-income, US Treasury bonds are generally considered the safest. They’re backed by the full faith and credit of the US government. However, long-term treasury bonds currently carry more risk due to economic uncertainty and potential policy changes. While corporate bonds can be a good investment, they are currently priced high, and their yields are not as attractive compared to treasury bonds. We believe short-term treasury bonds and municipal bonds are your best bet for fixed-income investments right now, as they offer safety and potential tax advantages. How this affects you depends on your location of residence, tax bracket, and investment goals. Contact us for a tailor-made investment portfolio that fits your needs.

Investing in Stocks

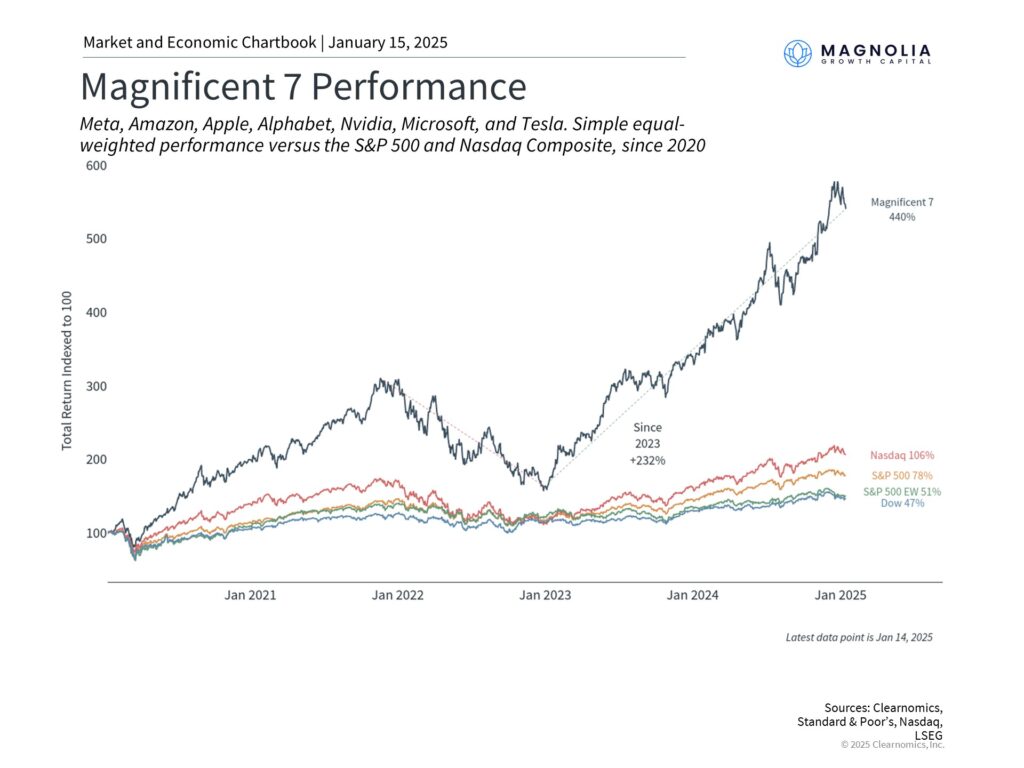

The valuations in the US are near an all-time high because growth investing tends to involve investing in “Big Tech” and high-growth companies competing in artificial intelligence and cloud services. If you haven’t been investing in these companies, then it’s probably worth being selective and not taking on more risk this year since these stocks are fairly overpriced. You can also see how these companies have carried S&P 500 to new heights since 2023 from the chart below.

Furthermore, companies with high leverage and those that borrowed with adjustable rates are also expected to not do so well. Mainly because adjustable rates tend to move with long-term rates making refinancing harder. They also incur higher interest expenses as a result and lower cashflow for the investors owning these companies.

When rates are higher for longer, consumers tend to trade down. This means your typical consumer is more likely to buy at Walmart over Target, Ulta Beauty over Sephora, CarMax over buying a new car. Higher rates and steepening yield curves also tend to bring the valuations of high growth companies down as these companies tend to finance their growth by borrowing at higher rates and growing at all costs becomes difficult.

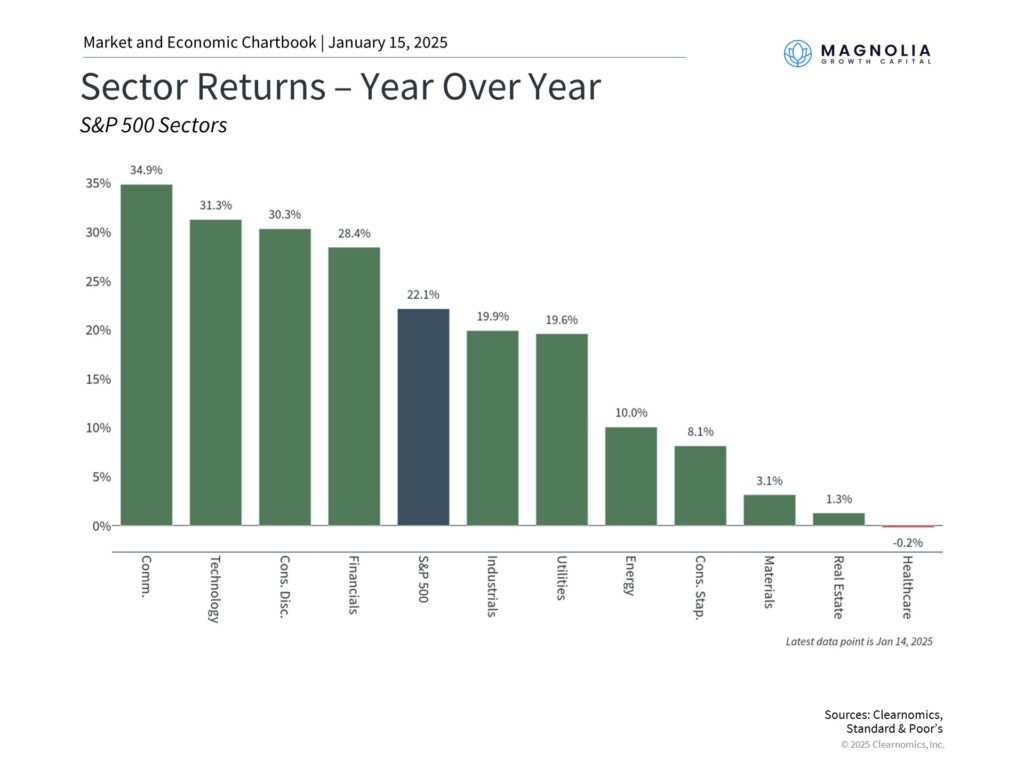

The chart below shows the distribution of returns within S&P 500 across sectors. Most stock market sectors have benefited from overall market trends over the past year. Technology-driven sectors, including artificial intelligence stocks, led the market until recently.

For 2025, investing in consumer defensive stocks is a great bet. We also believe that changes in banking regulations, tariffs on imports, and lower taxes will benefit industrials and financial sectors, but we’ll delve deeper into those industries in future blog posts. Cosmetics companies like e.l.f Cosmetics, and Ulta Beauty both tend to cater to consumers that are looking for price points that don’t cost a fortune.

Read this carefully before you make your decision: While we discuss company fundamentals, a proper assessment of whether a particular security fits your investment profile can only be made after a comprehensive review of your risk tolerance, investment objectives, and financial knowledge. Only then can we provide tailored investment advice, including position sizing, entry and exit points, and other relevant details.

Ulta Beauty

Ulta Beauty is expecting slower growth but their underlying business has all the luster for millennials, Gen Z, and investors alike. It has built a successful loyalty program with 45 million members and they drive 95% of its sales and have a 70% retention rate. The company is expected to generate $1 billion in free cash flow for the year and buyback shares which could certainly appeal to investors who don’t mind slower growth but appreciate profitability and shareholder value.

e.l.f. Cosmetics

e.l.f. Cosmetics tends to price their products at the lower end of the price range compared to premium brands like Estee Lauder. One can argue that the quality is more the same as e.l.f. Cosmetics are highly reviewed for their ingredients and ethical practices. This company is quite suitable for ESG investing. With a board of directors that is 78% women and 44% diverse, the company sources products responsibly, and is 100% cruelty free. For investors looking beyond ESG and at fundamentals, the company derives over 50% of its revenue from retailers Walmart and Target. While this data point is a major risk, they are tapping into other distribution channels, markets, and retailers which should mitigate those risks. They are increasing their market share in the international markets that are price-sensitive compared to the US, Canada, and UK. With over 23 quarters of sales growth in double digits, the company has just turned the corner in growing its gross margin, net profitability, capital efficiency, and free cash flow. And most importantly, the company is fairly priced and has more room to grow even from a pricing standpoint.

Investing in ETFs

Investing in ETFs and Index Funds is also your best bet and our most recommended strategy for many investors. It’s never too late to invest in S&P 500 tracking index funds if you are planning for long-term growth. For investors looking to ESG investing, then Vanguard FTSE Social Index Fund Admiral (Ticker: VFTAX) is a great option but remember this is a Mutual Fund and depending on the type of account you own, there are tax implications from distributions of funds. These index funds have most of the weight in the technology space but most investors should continue to benefit from broad diversification across sectors and industries as the world stabilizes. Lastly, if you are looking to diversify away from US markets, Japan is also an attractive investment market option. For more on our thesis, refer to our earlier blog post Why you invest in Japan.

Interest Rates and Homeownership

Our outlook for many of the potential homeowners is also bleak. Unless you have saved up a lot or are getting help from your family to buy the house outright, it’s going to be hard to own a house if you need a mortgage. So for these homebuyers, who missed out on the buying opportunity during COVID years when the interest rates on the mortgage was less than 3%, it’s highly unlikely that the rates will come down anytime soon. This is because mortgage rates tend to follow 10-year treasury rates and with potential reasons we discussed above, the rates are unlikely to come down this year.

If you were saving money and set aside for a down payment, now is the time to think about alternatives on increasing your potential returns and opportunity costs by talking to us. We can recommend a strategy that balances principal protection and also enhances return.

Important Disclaimer:

The information provided in this blog post is for general informational purposes only and should not be considered investment advice. Investing involves risks, including the potential loss of principal. Any recommendations made here are subject to change without notice.

Before making any investment decisions, it is essential to conduct thorough research, consider your individual financial situation and risk tolerance, and consult with a financial advisor.